How to Build Passive Income

My son, Josh Mettle, just interviewed me for his Physician Financial Success Podcast on iTunes. I hope you give it a listen while you’re walking your dog, hiking or traveling up the coast 🙂 You will learn (among other things):

- The kind of stuff they never teach you in real estate school.

- What I learned from Donald Trump about picking up great properties.

- How to bootstrap your way into income property investment.

- How to weather the storm when markets move from good to bad to good again.

- How to retire with cash flow.

- How to start!

If you have a secret desire to bridge from the billable hour to passive income for life, this may help you get started. Enjoy!

Advice for Tenants

A tenant asked me today why I didn’t have any advice for tenants at my blog. That kind of stumped me, because this blog is for landlords.

But I actually do have some very important advice for tenants: Buy a home. Do it now. Don’t wait.

Interest rates are going up, and you’ll be able to buy less and less home in the future because of the higher cost of money.

You’re welcome.

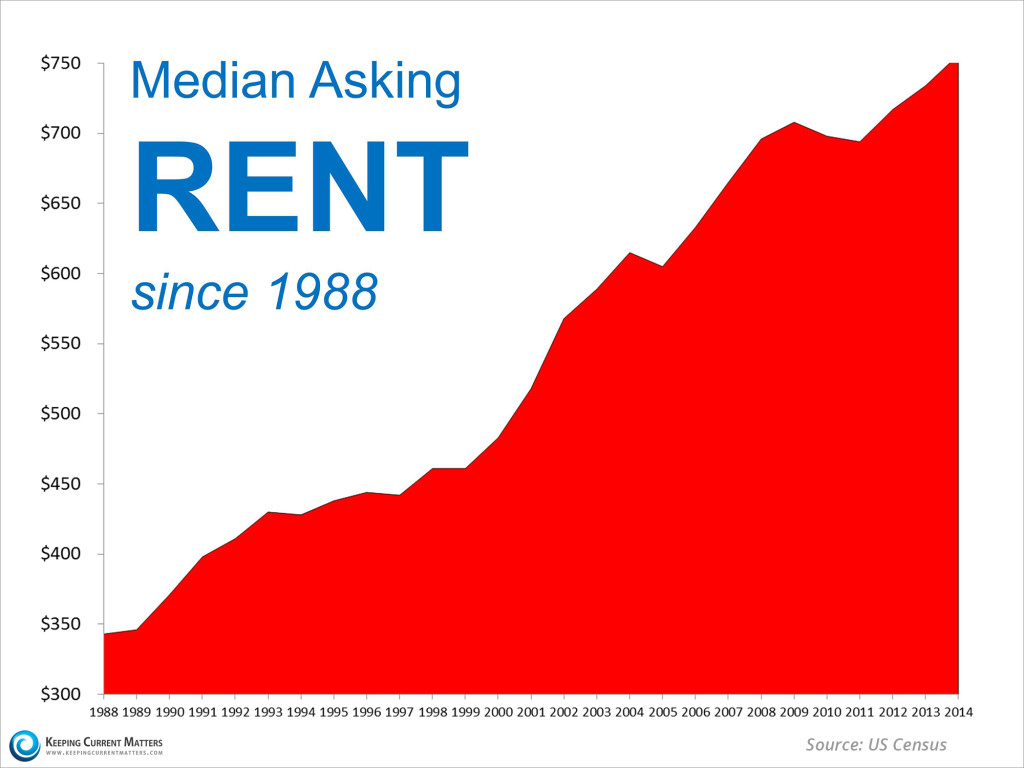

Rents are Climbing!

Here’s a chart showing U.S. rent increases over the last 25 years. This is not a big surprise for any income property investor, but dang that chart is pretty impressive! Read the details at the KCM Blog.

Highest Ever Rents Banked in 2014

A stunning $441 Billion was banked in rents in the U.S. in 2014, according to our friends at the KCM Blog. This is a $20 Billion increase over the year before.

Zillow’s Chief Economist predicts that 2015 will be more of the same.

Read the whole story at the KCM Blog.

Photo credit: mcfcrandall via photopin cc

What is Possible in 2015?

One of the main things that sets you aside as a landlord, real estate investor and entrepreneur, is that you have vision. You create new futures, new goals, new, renewed and improved properties, beautiful environments and other happy living circumstances. You are a leader.

Most people only see what’s in front of them. Most people find it difficult to envision a future that is not already there.

Entrepreneurs see things that are not there yet and then make them come into being.

Here’s a couple of examples from my own family:

My Dad was always considered a “wild man” because (among other things) he believed in his visions of the future and took big risks to make them happen.

Dad never waited for permission, agreement or approval.

He used to drive through Kanab, Utah on his way to boat at Lake Powell or vacation in Phoenix. Dad just loved the Kanab town and red sand.

So he bought 500+ acres of it.

Our family all thought he was out of his mind. My Mom actually went on strike for a couple of years.

The people in Kanab thought that the sage brush and red sand was only good for grazing cattle.

But Dad envisioned a bridge across the river, a beautiful subdivision of acre-plus ranchettes and his very own “No Bull Ranch” with three canyons backed up to BLM land that goes forever.

And that’s what exists there now.

Before that, Dad had a landscaping business and a nursery on a few acres in West Valley City, Utah. So naturally, he decided to bulldoze it and build 90 apartment units.

One day Dad was out on his tractor grading the land in preparation for building, when a black limo pulled up out front and a man inside asked one of Dad’s workmen where the owner was. The workman pointed to Dad on the tractor, and the man from Aetna said “give him the loan.” (This actually happened in the real world!)

Entrepreneurs have vision, and the leadership to make that vision come into existence.

My inspiration for this New Year 2015 post was a podcast I just listened to by Eben Pagan. Eben says:

“As an entrepreneurial leader you are the keeper of a very special flame — the vision of a better future…. As the leader, your ability to envision a better future and then translate that vision to others is priceless.”

Eben also points out that it’s key to keep believing in yourself and the future you envision:

“Even. When. Other. People. Don’t.”

[By the way, if you haven’t subscribed to Eben’s podcasts you are missing out on some wonderful entrepreneurial leadership that will inspire you to grow your business to the next level in 2015. I highly recommend it.]

Remember this quote from Steve Jobs?

“A lot of times, people don’t know what they want until you show it to them.”

Could there be any better example of leadership and entrepreneurial vision than Steve Jobs?

So let’s make this personal. What can we envision in 2015:

- That would enhance the lives of our tenants?

- That would enlarge our cash flows?

- That would improve the value of our property?

- That would contribute positively to the neighborhood?

- That would build our business and our estate?

- That would “put a dent in the universe?” (Steve Jobs)

I don’t know about you, but I have a lot of work to do!

So here’s to you and me having some wonderful visions of a better future in 2015. Let’s get out there and bring them into existence.

How to Build Passive Income Streams

My son and investment partner, Josh Mettle, has a new podcast: Physician Financial Success, which teaches physicians how to avoid financial landmines. Dr. David Phelps teaches professionals how to stop trading time for dollars and transition from earned income to passive income. The two of them got together for this really great podcast.

I’m a “retired” attorney, which makes me kind of an odd bird. When I got ready to retire, I then had a full time crazy-busy law practice and I co-owned and self-managed 70 houses and apartment units in my “spare time” with the help of my daughter-in-law. I called the Bar and asked if there was some kind of a checklist or roadmap for how to wrap up a practice and retire. Apparently, attorneys don’t retire, they just have heart attacks and die. I wanted to skip that part! So I had to invent my own off-ramp.

Dr. David Phelps seems to have systemized it.

If you have a secret desire to transition from the billable hour to passive income, it’s worth 30 minutes to listen to these two smart investors discuss the process.

It’s like dessert without the calories!

P.S. You can sign up for Josh’s new podcast at iTunes if you want to hear more great investment advice while you walk your dog or commute to work 🙂

“No Vacancies” A Landlord’s Favorite Words

One thing you can count on in business (and in life) is change…so I thought I better show off real quick before something changes.

To start off this new year, we have 87 apartments with No Vacancies!!

I can’t even remember the last time that happened.

We do have one vacant house…but houses are a different business in our world so I can brag about the apartments separately. (That’s my story and I’m sticking to it.)

We had huge turnover last summer. We decided it was a perfect time to sell a few houses, so we asked a few long term month-to-month tenants to leave for that purpose. Then suddenly we had some other long term tenants give us notices. Gulp.

At one point last summer we had 8 vacant houses. Eight.

Plus normal spring and summer apartment turnover.

So I was one stressed out lady when the cash/bills graphs got crossed (bills up, cash down). Filling vacancies is always my absolute top priority, so I had little time to blog. I’ll try to get in a little pontificating now.

Josh and I would like to add a new apartment complex this year, so I probably won’t be basking in the No Vacancies glow for long 🙂

Does Your Credit Score Affect Your Insurance Cost?

As landlords, we all know how important it is to run credit checks on rental applicants. I’m looking for the words “As Agreed, As Agreed, As Agreed” down that right hand column. I want to know if the applicants keep their agreements.

As investors, we all know how important it is to maintain a great credit report to get the lowest loan rates.

But did it ever occur to you that your credit report affects your insurance premiums?

Carrie Van Brunt-Wiley, Editor of the HomeInsurance.com blog gave permission to reprint her great article on the subject. Enjoy!

“Your credit score and your insurance payments- what’s the connection?

“You’re likely not surprised when your loan officer asks for your social security number- a thorough credit check is standard when applying for a loan. However, many consumers are caught off-guard when a homeowners insurance agent asks for their social security number. It’s widely debated, but quite commonly practiced- for an insurance carrier to use a customer’s credit score to determine their insurance premiums.

“What does your credit score really mean to your potential insurance carrier?

“While many businesses will use a consumer’s credit score to determine eligibility for a line of credit or to discern whether a deposit should be held for an advance of services, insurance companies actually perform a different type of credit inquiry that they use for a very different reason.

“A “Soft” Credit Check

“First and foremost, it’s important to know that when an insurance company runs your credit they are actually performing what is called a “soft” credit check which accesses only your credit score and is not reflected as an inquiry on your credit report. As you probably can surmise, this is different from a “hard” credit check that a lender, for example, may run which does show up on your credit report as an inquiry. Since credit inquiries from “hard” credit checks can hurt your overall score it’s good to limit these types of credit checks when shopping for a mortgage, for example. However, since insurance carriers only perform a “soft” credit check you can feel free to shop for multiple insurance quotes without worrying about hurting your credit rating.

“What they use it for

“Here’s where a lot of confusion, and sometimes even frustration, can set in from a consumer’s perspective. Once an insurance company has your credit score, they use it (along with many other factors about you and your home, car, etc.) to assign you an “insurance score”. This insurance score reflects your potential risk to the insurer.

“The insurance carrier then takes your risk potential and calculates your premiums. The more risk you pose, the higher your premiums will most likely be. This is where the real question comes in:

“What does poor credit history have to do with my potential to file a claim?

“If you’re asking this question, you’re not alone.

“There is much debate over the use of credit scoring as a way to determine risk, and therefore assign rates to insurance consumers. However, insurance companies defend the practice saying that studies have shown a direct correlation between a person’s credit score and their likelihood to file a claim. Therefore, consumers with a lower credit score often pay higher rates for insurance.

“Whether you agree with the practice or not, qualifying for better insurance premiums is just one other way that you can save money by keeping a good credit rating.”

About Carrie Van Brunt-Wiley

About Carrie Van Brunt-Wiley

Carrie Van Brunt-Wiley, is the Editor of the HomeInsurance.com blogs. Carrie graduated from the University of North Carolina at Wilmington with a BA in Professional Writing and Journalism. She has been managing research and content development for the HomeInsurance.com network of sites since 2007.

Warren Buffett on Gold vs. Income-Producing Investments

This is the best tutorial I’ve ever found on gold as an investment. So I thought I’d share:

This is the best tutorial I’ve ever found on gold as an investment. So I thought I’d share:

“Gold is a huge favorite of investors who fear almost all other assets, especially paper money. But what motivates most gold purchasers is their belief that the ranks of the fearful will grow.

“The world’s gold stock is 170,000 metric tons. If all of the gold were melded together, it would form a 68-foot cube – and fit in a baseball infield. At $1,750 per ounce … [last year] its value would be $9.6 trillion. Call this cube pile A.

Now create pile B. For 9.6 trillion, we could buy all U.S. cropland (400 million acres producing $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor selecting pile A over pile B?”

[Photo credit: Fortune Live Media via photopin]

Positive cash flow, equity build-up, depreciation…

How many reasons do you need to invest in income property?

Positive cash flow, equity build-up, depreciation, tax write-offs, leverage, the thrill of making things beautiful, building passive income for retirement, building an estate that can be passed on to your heirs. There’s a few reasons off the top of my head.

Here’s another reason: it’s so much fun!

Josh and I bought a little 7-plex at the end of October, 2012.

Six months later it has a new roof, new parking lot, new landscaping, gorgeously renovated units, and a lovely new tenant clientelle.

We have increased the annual rental income by $23,000.00. (!!!!)

All of you number crunchers know that we have thereby increased our equity in the project by some fairly impressive number in the six figures.

That was the fun part.

But there was also a scary part when we had big renovations sums flowing out of our bank account with little rent flowing in. Gulp.

Six of the units are probably still $50.00 per month under market, but I started marketing in the middle of winter when no one wanted to move so I got scared for a minute and dropped the rents to get them renting.

This was a perfect small project to use as a case study, so I’m writing an e-book which will walk budding investors through the process from beginning to end. I’ll let you know when it’s ready for public consumption 🙂

In the mean time, I can’t remember a better time to buy rental property. I hope you are paying attention.