How to Build Passive Income

My son, Josh Mettle, just interviewed me for his Physician Financial Success Podcast on iTunes. I hope you give it a listen while you’re walking your dog, hiking or traveling up the coast 🙂 You will learn (among other things):

- The kind of stuff they never teach you in real estate school.

- What I learned from Donald Trump about picking up great properties.

- How to bootstrap your way into income property investment.

- How to weather the storm when markets move from good to bad to good again.

- How to retire with cash flow.

- How to start!

If you have a secret desire to bridge from the billable hour to passive income for life, this may help you get started. Enjoy!

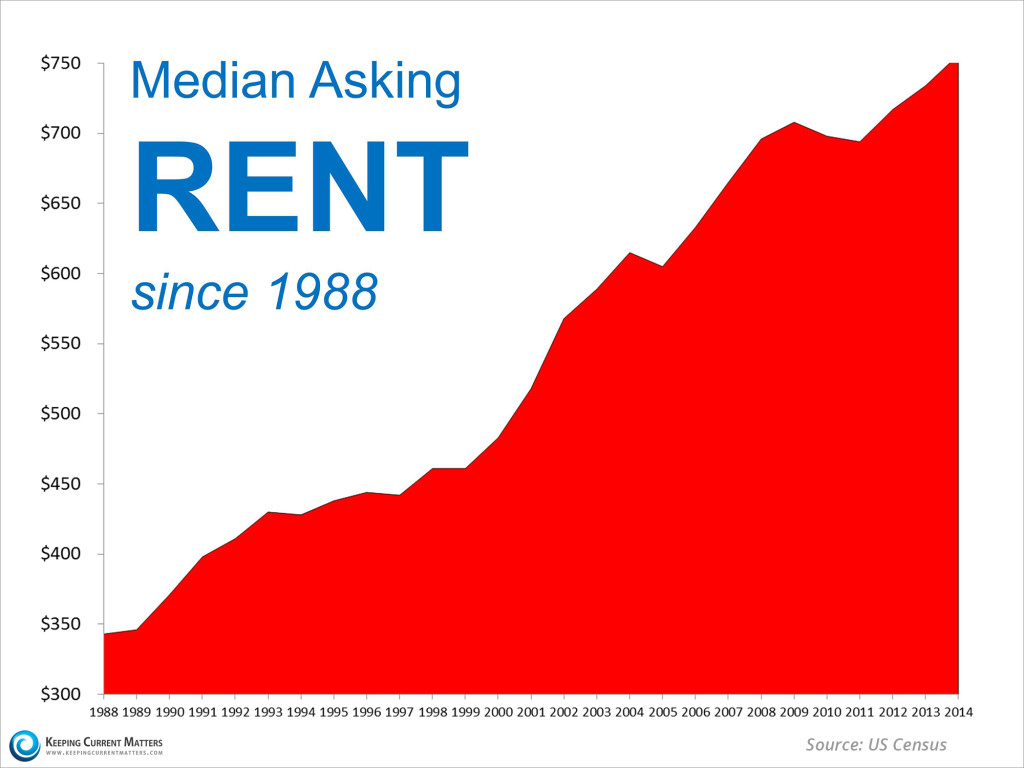

Rents are Climbing!

Here’s a chart showing U.S. rent increases over the last 25 years. This is not a big surprise for any income property investor, but dang that chart is pretty impressive! Read the details at the KCM Blog.

How to Become a Weekend Millionaire

Twelve years ago I had virtually no assets. Zip, zero, butkis. To balance that out, I had big law school student loans (which I’m still paying), and a new law practice. Retirement funds? No way.

What I did have is a strong work ethic, a great education, an enormous ability to work hard and produce, and I’m honest. That made me a good prospect as a partner.

My son/investment partner Josh, was busy building his loan business. He has a fantastic business sense, a strong work ethic, an enormous ability to work hard and produce, and he’s honest. That made him a good prospect as a partner.

So we were off to the races.

When I look back now, I have no idea how we pulled off most of what we pulled off. It was sheer intention.

I was getting older (just between you and me) and needed to get serious about putting together a retirement. Josh was young and needed an investment plan so he didn’t party away his income.

As a loan broker, Josh has seen thousands of credit applications, and he says that almost everybody lives beyond their means, no matter how much money they make. Very few people have income producing assets.

Think about that.

In about the last 12 years, I have bridged from earned income (the dreaded billable hour) to passive income. I have an income for life and assets with equity that I can pass on to my loved ones. I have a tremendous sense of peace and well being from that accomplishment.

That’s self made wealth.

I still work hard every day. I never have to show up for work and wait for someone to tell me what to do. I get to select my goals and choose my projects.

The only purpose for this little exercise in rear view mirroring is to say to you….if I can do it, anyone can do it.

There’s a book I wish I would have written that I want to recommend: “The Weekend Millionaire’s Secrets to Investing in Real Estate: How to Become Wealthy in Your Spare Time,” by Mike Summey. Mike retired at age 50 with a 7-figure annual income from his rental properties. He started investing at age 34 while working at a demanding job. Over time he purchased hundreds of rental properties in his spare time. Mike has already walked the path. You don’t have to invent it. Get his book and start by following his program.

It’s doubtful that we will ever see real estate loans again at interest rates where they are now.

I hope every person who reads this blog will take the next step to becoming a weekend millionaire by adding at least one rental property in 2014. Then follow Mike Summey’s program and keep going until you reach your own wonderful retirement, with cash flow.

“No Vacancies” A Landlord’s Favorite Words

One thing you can count on in business (and in life) is change…so I thought I better show off real quick before something changes.

To start off this new year, we have 87 apartments with No Vacancies!!

I can’t even remember the last time that happened.

We do have one vacant house…but houses are a different business in our world so I can brag about the apartments separately. (That’s my story and I’m sticking to it.)

We had huge turnover last summer. We decided it was a perfect time to sell a few houses, so we asked a few long term month-to-month tenants to leave for that purpose. Then suddenly we had some other long term tenants give us notices. Gulp.

At one point last summer we had 8 vacant houses. Eight.

Plus normal spring and summer apartment turnover.

So I was one stressed out lady when the cash/bills graphs got crossed (bills up, cash down). Filling vacancies is always my absolute top priority, so I had little time to blog. I’ll try to get in a little pontificating now.

Josh and I would like to add a new apartment complex this year, so I probably won’t be basking in the No Vacancies glow for long 🙂

Warren Buffett on Gold vs. Income-Producing Investments

This is the best tutorial I’ve ever found on gold as an investment. So I thought I’d share:

This is the best tutorial I’ve ever found on gold as an investment. So I thought I’d share:

“Gold is a huge favorite of investors who fear almost all other assets, especially paper money. But what motivates most gold purchasers is their belief that the ranks of the fearful will grow.

“The world’s gold stock is 170,000 metric tons. If all of the gold were melded together, it would form a 68-foot cube – and fit in a baseball infield. At $1,750 per ounce … [last year] its value would be $9.6 trillion. Call this cube pile A.

Now create pile B. For 9.6 trillion, we could buy all U.S. cropland (400 million acres producing $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor selecting pile A over pile B?”

[Photo credit: Fortune Live Media via photopin]

Positive cash flow, equity build-up, depreciation…

How many reasons do you need to invest in income property?

Positive cash flow, equity build-up, depreciation, tax write-offs, leverage, the thrill of making things beautiful, building passive income for retirement, building an estate that can be passed on to your heirs. There’s a few reasons off the top of my head.

Here’s another reason: it’s so much fun!

Josh and I bought a little 7-plex at the end of October, 2012.

Six months later it has a new roof, new parking lot, new landscaping, gorgeously renovated units, and a lovely new tenant clientelle.

We have increased the annual rental income by $23,000.00. (!!!!)

All of you number crunchers know that we have thereby increased our equity in the project by some fairly impressive number in the six figures.

That was the fun part.

But there was also a scary part when we had big renovations sums flowing out of our bank account with little rent flowing in. Gulp.

Six of the units are probably still $50.00 per month under market, but I started marketing in the middle of winter when no one wanted to move so I got scared for a minute and dropped the rents to get them renting.

This was a perfect small project to use as a case study, so I’m writing an e-book which will walk budding investors through the process from beginning to end. I’ll let you know when it’s ready for public consumption 🙂

In the mean time, I can’t remember a better time to buy rental property. I hope you are paying attention.

Fund Your Retirement with Rental Income

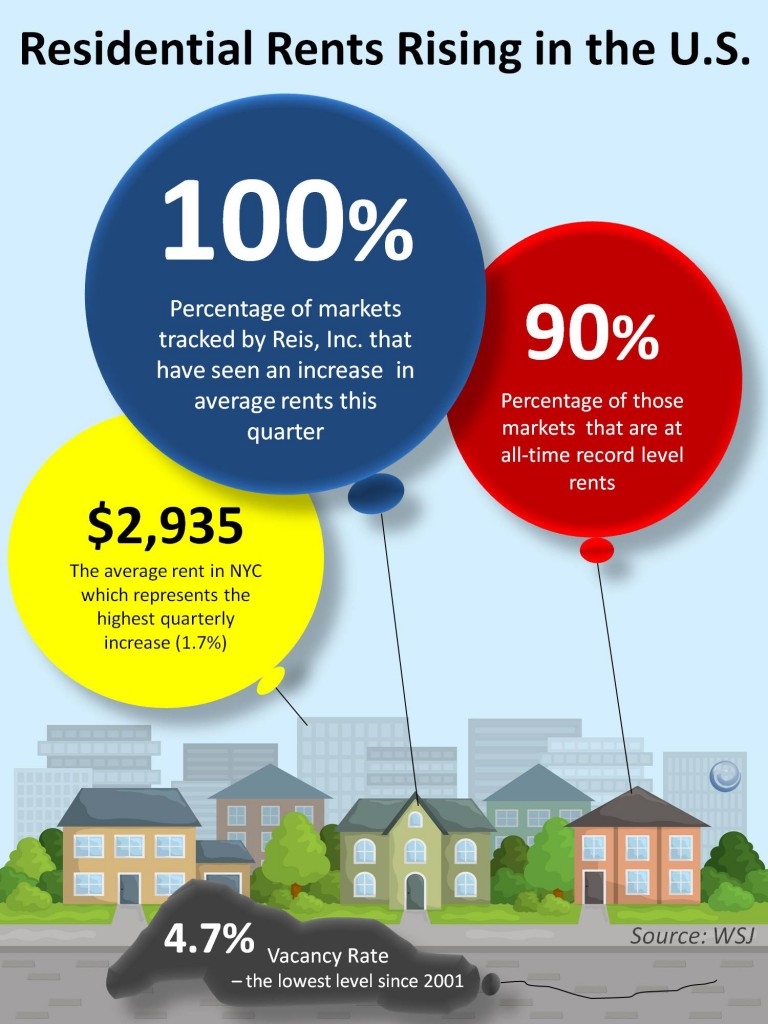

More Good News for Landlords

This great new info-graphic from our friends at The KCM Blog shows visually that landlords are getting special again.

This great new info-graphic from our friends at The KCM Blog shows visually that landlords are getting special again.

100% of markets tracked saw an increase in rents this quarter.

As landlords, we go through periods where we don’t feel very special (the recent recessionary years come to mind).

And then we have periods when we feel very special…when rents are rising and units fill fast (and banks lend us money)!

I signed leases with highest-ever rents on 6 different properties in the past month – both homes and apartments.

There were feeding-frenzies with multiple applicants on each of those properties. The feeding-frenzies repeated even though I made pretty big rent increases on all the homes and apartments that turned over.

Several times I had to take the ads down within 24-48 hours of posting to get the phone to quit ringing.

I figured the rents must be too low.

Each time the feeding-frenzie happened, I re-researched the market and raised the rents again.

This is a great problem 🙂

Fund Your Fabulous Retirement with Cash Flow from Rental Property

Recently, I got an email that went something like: “Sure, right, easy for you to say. You can buy rental property because you have a law degree and money and credit.”

Recently, I got an email that went something like: “Sure, right, easy for you to say. You can buy rental property because you have a law degree and money and credit.”

Huh?

Let me just say, that when I started investing in real estate with my son, I was fresh out of law school with huge student debt, in my mid-40s, no money, no time, no retirement plan, and barely any credit. Plus, I had just finished a 14 year stint as a single-mom.

Yep, I was really special.

We made only a tiny bit of profit on our first investment, after investing a whole summer of work. (We made the mistake of trying to be flippers. Now that I think of it, that was only one of a huge number of mistakes!)

We went negative on our second investment, a condo, which went down in value about $25K the first year we owned it because of a ton of foreclosures in that development. The condo is now worth double what we paid for it with a nice positive cash flow.

On our third investment, an eight-plex (which we had no business buying), we found out at the last minute after investing $15,000.00 earnest money, $3500+ for an appraisal and inspections, etc., that we couldn’t qualify for the loan. I wasn’t willing to walk away, so I broke down and begged a relative for the loan. It was horribly embarrassing. The relative gave us the loan and took a first position lien (because the property was a good investment) at a whopping 8.5% interest. We had no track record, so we paid through the nose for the first three years that we owned that property. My son and I did all the work (in our spare time after hours and weekends) for the first three years. Plus it was negative cash flow and Josh and I had to work to feed the creditors. (Please don’t follow this example!) After that we were able to refinance at 6.5% interest and we finally had positive cash flow. Today, 8.5 years after the purchase, the property is worth twice what we paid for it and we are currently refinancing for about 3.85%. Booya! Now we’re talking cash flow.

So don’t be a big stinking crybaby! (To paraphrase Donald Trump.)

Let me tell you what is way more valuable than money or credit. It’s the burning DESIRE, the drive, the motivation to be successful, to win, to be self-made. This is the entry ticket to the game. If you have this great desire, it’s game on.

You are going to make mistakes. You will sometimes lose money. You will experience frustration and aggravation and nasty little punks that get all up in your face. You will start out working long hours. You won’t know how to do a thousand things.

But over time, you will experience pride and accomplishment. You will have a ton of fun making things look great and renting it to nice people, and you will fund your fabulous retirement before you know it.

You may have to be creative, especially to start. But if you actively look and actively make offers, suddenly you’ll find a property and a situation that will click.

Now get out there with a smile on your face and put together a great retirement…one cash-flowing rental property at a time!

2012 started with a fish taco attack in San Diego…

I had a fish taco attack when our plane landed in San Diego at noon on Christmas eve. Josh and Hillary gave me a new iPhone 4S, so we asked Siri for the best fish taco place in San Diego. She gave us the top 14 fish taco restaurants in order of popularity by customer ratings, and we spent the next ten days in search of the perfect fish taco. It was a great and tasty adventure! We had my little grandkids Zander and Aria with us, so we relaxed and did lots of kid stuff and lots of walking. We hit the zoo twice, the wild animal park, Sea World, the beach, fabulous sunsets, the works.

I had a fish taco attack when our plane landed in San Diego at noon on Christmas eve. Josh and Hillary gave me a new iPhone 4S, so we asked Siri for the best fish taco place in San Diego. She gave us the top 14 fish taco restaurants in order of popularity by customer ratings, and we spent the next ten days in search of the perfect fish taco. It was a great and tasty adventure! We had my little grandkids Zander and Aria with us, so we relaxed and did lots of kid stuff and lots of walking. We hit the zoo twice, the wild animal park, Sea World, the beach, fabulous sunsets, the works.

2011 was our best year ever! We worked smarter, and got leaner and meaner. We think 2012 will be a great year to increase and add cash flows. We have several plans in the works and will keep you informed as we pull them off. The landlording business is a ton of fun and a great retirement gig. I hope you have as much fun this year as I’m having!