How to Build Passive Income

My son, Josh Mettle, just interviewed me for his Physician Financial Success Podcast on iTunes. I hope you give it a listen while you’re walking your dog, hiking or traveling up the coast 🙂 You will learn (among other things):

- The kind of stuff they never teach you in real estate school.

- What I learned from Donald Trump about picking up great properties.

- How to bootstrap your way into income property investment.

- How to weather the storm when markets move from good to bad to good again.

- How to retire with cash flow.

- How to start!

If you have a secret desire to bridge from the billable hour to passive income for life, this may help you get started. Enjoy!

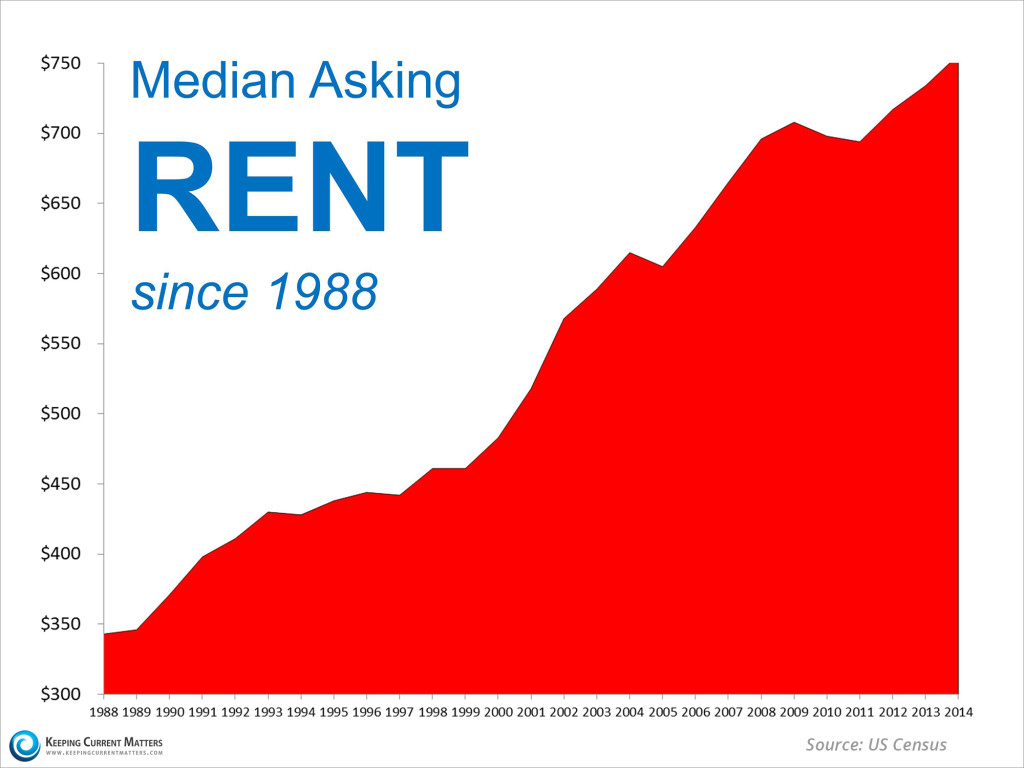

Rents are Climbing!

Here’s a chart showing U.S. rent increases over the last 25 years. This is not a big surprise for any income property investor, but dang that chart is pretty impressive! Read the details at the KCM Blog.

2014 Residential Rental Market Survey

National Apartment AssociationUnits Magazine, September 2014

“2014 will likely go down as the formal beginning of the shift to a renter-based society.”

Thus sayeth the National Apartment Association in the September 2014 issue of Units Magazine.

Great for investors.

Not great for our kids and grandkids.

How to Build Passive Income Streams

My son and investment partner, Josh Mettle, has a new podcast: Physician Financial Success, which teaches physicians how to avoid financial landmines. Dr. David Phelps teaches professionals how to stop trading time for dollars and transition from earned income to passive income. The two of them got together for this really great podcast.

I’m a “retired” attorney, which makes me kind of an odd bird. When I got ready to retire, I then had a full time crazy-busy law practice and I co-owned and self-managed 70 houses and apartment units in my “spare time” with the help of my daughter-in-law. I called the Bar and asked if there was some kind of a checklist or roadmap for how to wrap up a practice and retire. Apparently, attorneys don’t retire, they just have heart attacks and die. I wanted to skip that part! So I had to invent my own off-ramp.

Dr. David Phelps seems to have systemized it.

If you have a secret desire to transition from the billable hour to passive income, it’s worth 30 minutes to listen to these two smart investors discuss the process.

It’s like dessert without the calories!

P.S. You can sign up for Josh’s new podcast at iTunes if you want to hear more great investment advice while you walk your dog or commute to work 🙂

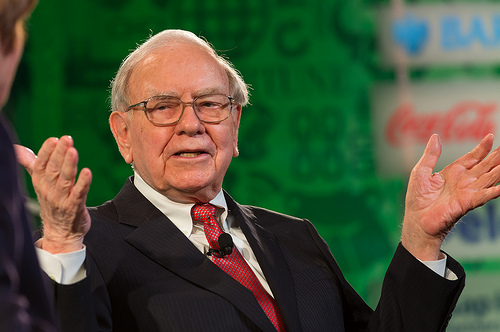

Buffett’s annual letter: What you can learn from my real estate investments

When Warren Buffett pontificates on two of his real estate investments, I think we should pause and pay attention. In this case, the real estate tutorial comes in the annual letter to Buffett’s shareholders!

When Warren Buffett pontificates on two of his real estate investments, I think we should pause and pay attention. In this case, the real estate tutorial comes in the annual letter to Buffett’s shareholders!

My son/partner Josh sent this to me and I think we both had slightly different takeaways. What impressed me is Buffett’s focus on his estimate of the future earnings of the assets when he considered their purchase, not the future value. (Josh is a numbers guy, and he’s going to write about his impressions of Buffett’s article in his monthly newsletter, so I’ll be interested in how his takeaways differ from mine.)

Future earnings. Not future value.

That’s easy on commercial properties, because the value of the property is determined by the income stream that it produces. So you can put all of your attention on increasing the income stream knowing that you are increasing value simultaneously. But homes are valued by comparables, they require a different discipline.

Having just lived through a recession as a landlord and real estate investor, I can tell you that we survived it because of the earnings from our investments. Cash flow saved us and got us through and in a stronger position than before the recession. We didn’t dwell on values because as long as we had positive cash flow, we were in a good position.

Please get a nice cup of your favorite beverage and take a few minutes to ponder Buffett’s message and it’s lesson for real estate investors:

Buffett’s annual letter: What you can learn from my real estate investments

By Warren Buffett

“Investment is most intelligent when it is most businesslike.” –Benjamin Graham, The Intelligent Investor

It is fitting to have a Ben Graham quote open this essay because I owe so much of what I know about investing to him. I will talk more about Ben a bit later, and I will even sooner talk about common stocks. But let me first tell you about two small nonstock investments that I made long ago. Though neither changed my net worth by much, they are instructive.

This tale begins in Nebraska. From 1973 to 1981, the Midwest experienced an explosion in farm prices, caused by a widespread belief that runaway inflation was coming and fueled by the lending policies of small rural banks. Then the bubble burst, bringing price declines of 50% or more that devastated both leveraged farmers and their lenders. Five times as many Iowa and Nebraska banks failed in that bubble’s aftermath as in our recent Great Recession.

In 1986, I purchased a 400-acre farm, located 50 miles north of Omaha, from the FDIC. It cost me $280,000, considerably less than what a failed bank had lent against the farm a few years earlier. I knew nothing about operating a farm. But I have a son who loves farming, and I learned from him both how many bushels of corn and soybeans the farm would produce and what the operating expenses would be. From these estimates, I calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity would improve over time and that crop prices would move higher as well. Both expectations proved out.

I needed no unusual knowledge or intelligence to conclude that the investment had no downside and potentially had substantial upside. There would, of course, be the occasional bad crop, and prices would sometimes disappoint. But so what? There would be some unusually good years as well, and I would never be under any pressure to sell the property. Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid. I still know nothing about farming and recently made just my second visit to the farm. More…

How to Become a Weekend Millionaire

Twelve years ago I had virtually no assets. Zip, zero, butkis. To balance that out, I had big law school student loans (which I’m still paying), and a new law practice. Retirement funds? No way.

What I did have is a strong work ethic, a great education, an enormous ability to work hard and produce, and I’m honest. That made me a good prospect as a partner.

My son/investment partner Josh, was busy building his loan business. He has a fantastic business sense, a strong work ethic, an enormous ability to work hard and produce, and he’s honest. That made him a good prospect as a partner.

So we were off to the races.

When I look back now, I have no idea how we pulled off most of what we pulled off. It was sheer intention.

I was getting older (just between you and me) and needed to get serious about putting together a retirement. Josh was young and needed an investment plan so he didn’t party away his income.

As a loan broker, Josh has seen thousands of credit applications, and he says that almost everybody lives beyond their means, no matter how much money they make. Very few people have income producing assets.

Think about that.

In about the last 12 years, I have bridged from earned income (the dreaded billable hour) to passive income. I have an income for life and assets with equity that I can pass on to my loved ones. I have a tremendous sense of peace and well being from that accomplishment.

That’s self made wealth.

I still work hard every day. I never have to show up for work and wait for someone to tell me what to do. I get to select my goals and choose my projects.

The only purpose for this little exercise in rear view mirroring is to say to you….if I can do it, anyone can do it.

There’s a book I wish I would have written that I want to recommend: “The Weekend Millionaire’s Secrets to Investing in Real Estate: How to Become Wealthy in Your Spare Time,” by Mike Summey. Mike retired at age 50 with a 7-figure annual income from his rental properties. He started investing at age 34 while working at a demanding job. Over time he purchased hundreds of rental properties in his spare time. Mike has already walked the path. You don’t have to invent it. Get his book and start by following his program.

It’s doubtful that we will ever see real estate loans again at interest rates where they are now.

I hope every person who reads this blog will take the next step to becoming a weekend millionaire by adding at least one rental property in 2014. Then follow Mike Summey’s program and keep going until you reach your own wonderful retirement, with cash flow.

Warren Buffett on Gold vs. Income-Producing Investments

This is the best tutorial I’ve ever found on gold as an investment. So I thought I’d share:

This is the best tutorial I’ve ever found on gold as an investment. So I thought I’d share:

“Gold is a huge favorite of investors who fear almost all other assets, especially paper money. But what motivates most gold purchasers is their belief that the ranks of the fearful will grow.

“The world’s gold stock is 170,000 metric tons. If all of the gold were melded together, it would form a 68-foot cube – and fit in a baseball infield. At $1,750 per ounce … [last year] its value would be $9.6 trillion. Call this cube pile A.

Now create pile B. For 9.6 trillion, we could buy all U.S. cropland (400 million acres producing $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor selecting pile A over pile B?”

[Photo credit: Fortune Live Media via photopin]

Positive cash flow, equity build-up, depreciation…

How many reasons do you need to invest in income property?

Positive cash flow, equity build-up, depreciation, tax write-offs, leverage, the thrill of making things beautiful, building passive income for retirement, building an estate that can be passed on to your heirs. There’s a few reasons off the top of my head.

Here’s another reason: it’s so much fun!

Josh and I bought a little 7-plex at the end of October, 2012.

Six months later it has a new roof, new parking lot, new landscaping, gorgeously renovated units, and a lovely new tenant clientelle.

We have increased the annual rental income by $23,000.00. (!!!!)

All of you number crunchers know that we have thereby increased our equity in the project by some fairly impressive number in the six figures.

That was the fun part.

But there was also a scary part when we had big renovations sums flowing out of our bank account with little rent flowing in. Gulp.

Six of the units are probably still $50.00 per month under market, but I started marketing in the middle of winter when no one wanted to move so I got scared for a minute and dropped the rents to get them renting.

This was a perfect small project to use as a case study, so I’m writing an e-book which will walk budding investors through the process from beginning to end. I’ll let you know when it’s ready for public consumption 🙂

In the mean time, I can’t remember a better time to buy rental property. I hope you are paying attention.

“Biggest Mistake New Investors Make in Due Diligence”

Thanks to attorney and multi-family investor Charles Dobens for this excellent and insightful article on due diligence, which we found on the MultiFamily Insight Blog:

“What is the biggest mistake new investors make in multifamily due diligence? Due diligence is where many new investors start to go astray. They find a deal, make offers, get an offer accepted, put it under contract and then start the due diligence process. During the due diligence process their entire focus is centered around the real estate. They interview and negotiate rates with property inspectors. They set up a date and time that they will go through each and every unit looking for the most egregious example of poor management so that they can go back to the seller and negotiate a repair allowance.

“The owner of a bad property will see this coming a mile away and be prepared for it. They will inflate their purchase price to make you pay the repair allowance WITH YOUR OWN MONEY. They will play hardball with you and structure the terms of the repair allowance such that the dollars come out of the deal in an in-kind transfer and not in cash. You, at the end of the day, end up with a property that has a list of needed repairs and no cash to fix it.

“But that is not where your focus needs to be. Here’s where the new investor goes astray. After the property inspector has completed his task and submits his beautiful 100-page report that you pay for, you will review it and look at the last page that gives a dollar amount as to the needed repairs. You then go back to the broker and open the negotiations all over again and I can assure you, they are lying in wait for you to return.

“But the problem with this over-dependence upon the inspection report is that, no matter what the inspector finds, it can be fixed with one thing – Money. Just name your price and the roof is fixed. Get three bids and the foundation is fixed. The brokers focus, along with yours and everyone else is on the real estate. This is exactly where you should not be focused. More…