More Evidence of the Housing Recovery

How do stock market pro’s know the housing market is recovering? They look at stocks like Sherwin Williams (SHW) because share prices of companies that offer housing-related goods and services are “on a tear.”

How do stock market pro’s know the housing market is recovering? They look at stocks like Sherwin Williams (SHW) because share prices of companies that offer housing-related goods and services are “on a tear.”

According to Jeff Clark who writes the “Market Notes” for Dr. Steve Sjuggerud’s Daily Wealth blog:

“As today’s chart shows, there’s a safer way to bet on the housing boom… Sherwin Williams (SHW) is one of the world’s largest paint and coating producers. The stock is in a “slow and steady” uptrend. Its share price has more than doubled in the last 12 months. And it just reached a new all-time high.”

As the housing market is recovering, some investors are buying real property and some investors are buying housing-related stocks. It’s all good.

Fannie Mae Expands Investor Financing Options

Hey real estate investors…have you ever wondered when your bailout would come along? Well this may help out:

Hey real estate investors…have you ever wondered when your bailout would come along? Well this may help out:

“Fannie Mae recently announced expansion of it’s Homepath Mortgage product that provides home buyers and investors financing for the purchase of Fannie Mae-owned properties.

The new product will allow eligible individual and LLC borrowers to finance up to 20 properties using the Homepath Mortgage. NAR has long called for expansion of financing opportunities for investors as a way to increase the absorbtion of REO properties. Fannie Mae will offer flexible lending terms and will not require appraisals of the properties.

Visit Homepath.com for more information on the program and participating lenders.”

Thanks to the National Association of Realtors for this heads-up and for their smart advocacy.

“U.S. Housing is the Next Gold”

Dr. Steve Sjuggerud says that real assets are better than gold now. As real estate investors, we already know that. But now the cat is out of the bag! Read his blog post to get the scoop.

More Good News for Landlords

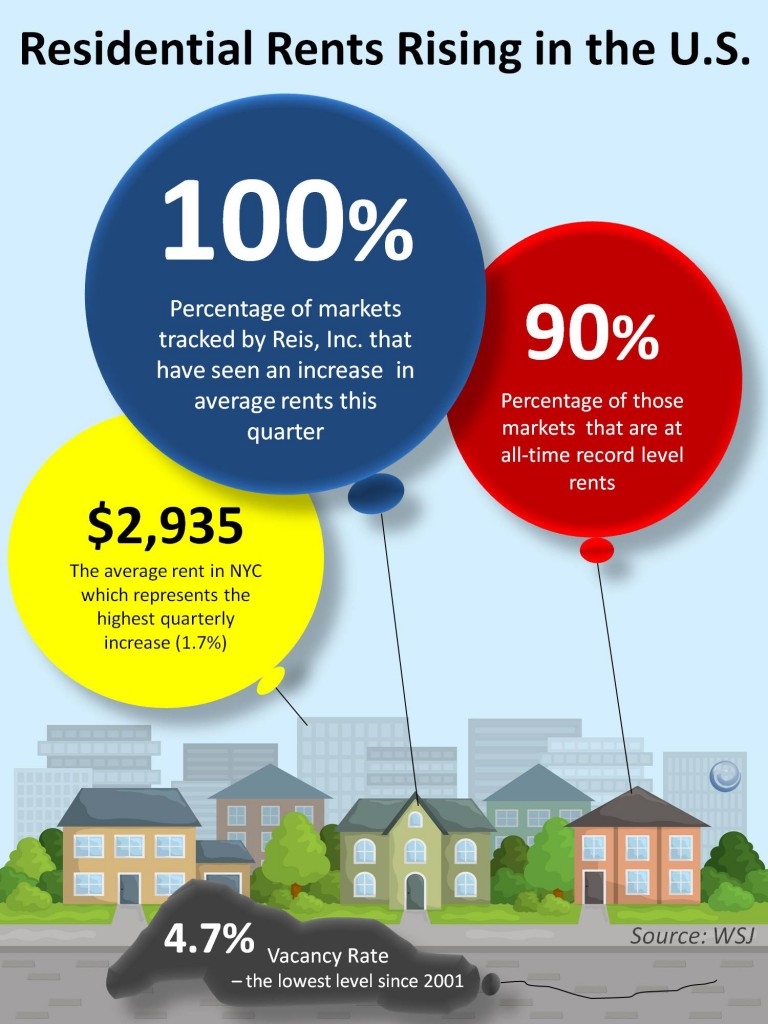

This great new info-graphic from our friends at The KCM Blog shows visually that landlords are getting special again.

This great new info-graphic from our friends at The KCM Blog shows visually that landlords are getting special again.

100% of markets tracked saw an increase in rents this quarter.

As landlords, we go through periods where we don’t feel very special (the recent recessionary years come to mind).

And then we have periods when we feel very special…when rents are rising and units fill fast (and banks lend us money)!

I signed leases with highest-ever rents on 6 different properties in the past month – both homes and apartments.

There were feeding-frenzies with multiple applicants on each of those properties. The feeding-frenzies repeated even though I made pretty big rent increases on all the homes and apartments that turned over.

Several times I had to take the ads down within 24-48 hours of posting to get the phone to quit ringing.

I figured the rents must be too low.

Each time the feeding-frenzie happened, I re-researched the market and raised the rents again.

This is a great problem 🙂

Are we at the bottom yet?

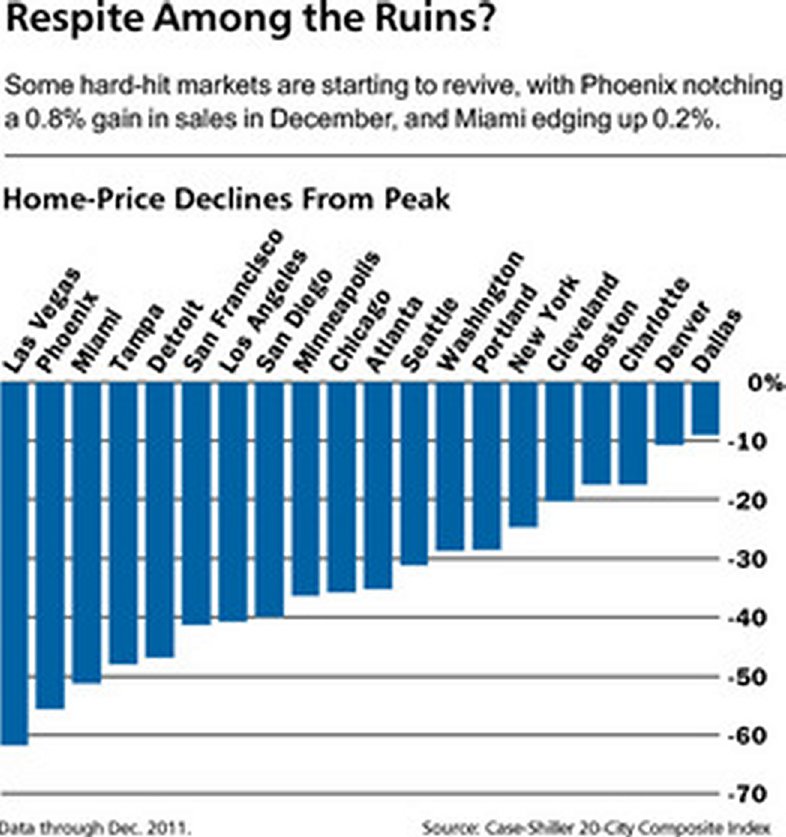

Read this interesting Barrons article from a real estate investor’s point of view. Investors want to buy at the bottom and hold for the rocket ride. We all suffer from that delicious fantasy. We all have sad stories of buying too late and selling too soon. But fantasy is “imagination unrestricted by reality.” So, rub your eyes and pay close attention to all the recovery indicators in the real estate market.

Read this interesting Barrons article from a real estate investor’s point of view. Investors want to buy at the bottom and hold for the rocket ride. We all suffer from that delicious fantasy. We all have sad stories of buying too late and selling too soon. But fantasy is “imagination unrestricted by reality.” So, rub your eyes and pay close attention to all the recovery indicators in the real estate market.

The Donald Loves Real Estate

Donald TrumpThe bottom line is I love real estate. I like it because I think you are going to have massive inflation at some point, and to me real estate is a much better hedge against inflation than gold, which you can't touch.

The Greatest Opportunity Ever Is Just About to Pass You By

Dr. Steve SjuggerudHow much louder can I say this? This moment is the greatest opportunity ever to be an American homebuyer. It is the best moment in history. We may never see opportunity this great in our lifetimes. Time's "a-wasting" actually... You're about to miss the best moment, if you don't get on it, right now. The "V" bottom (as I call it) – where you can get the very best prices – is passing you by as I type.

Don’t miss today’s article by Dr. Steve Sjuggerud! Go there and read it now. Seriously! Do it now.

Don’t miss today’s article by Dr. Steve Sjuggerud! Go there and read it now. Seriously! Do it now.

Good News for Landlords

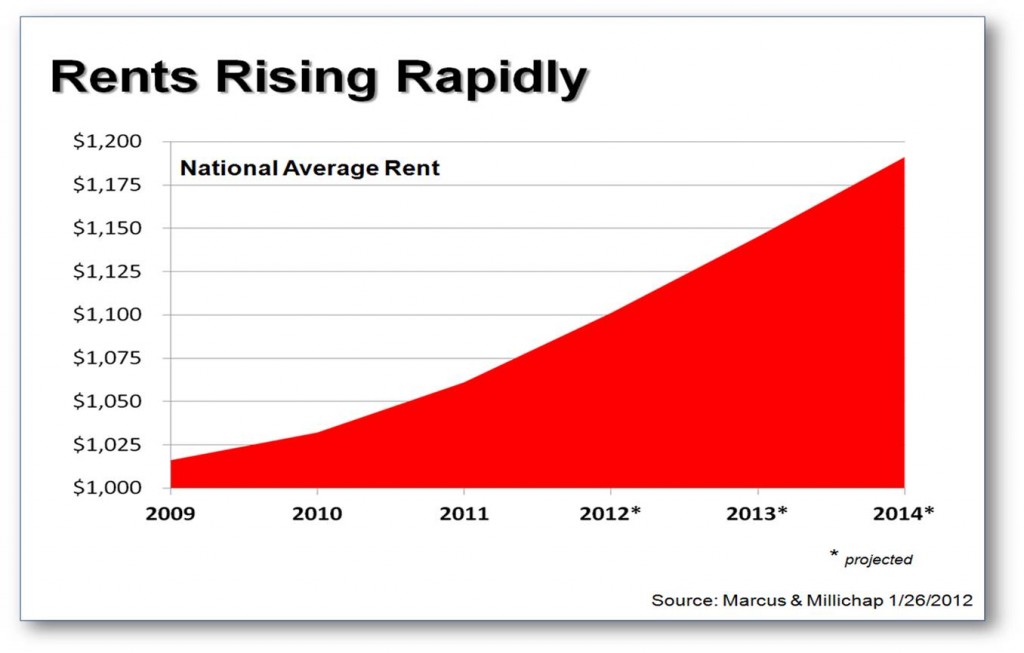

The KCM Blog just posted this happy graph, showing average national rent increases over the past three years and projected rent increases over the next three years based on a report from Marcus & Millichap.

The KCM Blog just posted this happy graph, showing average national rent increases over the past three years and projected rent increases over the next three years based on a report from Marcus & Millichap.

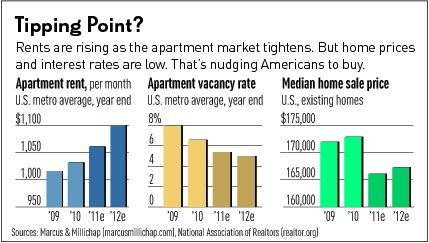

On the other hand, a recent Investor’s Business Daily article opines that high apartment rents are pushing renters to buy homes.

On the other hand, a recent Investor’s Business Daily article opines that high apartment rents are pushing renters to buy homes.

But fear not, because “more renters are on the way.” Supply and demand is on our side. There are a large number of echo boomers age 20 – 34 entering the rental market which are likely to make up for those who leave it.

All of this is terrific news for income property investors!

When the Prophet Says Buy — BUY!

Investors, if you are watching the market closely to determine if it’s time to buy: head’s up! Here’s another killer post from our friends at The KCM Blog that is a must read:

Investors, if you are watching the market closely to determine if it’s time to buy: head’s up! Here’s another killer post from our friends at The KCM Blog that is a must read:

“John R. Talbott, previously a Goldman Sachs investment banker, is a bestselling author and economic consultant. When it comes to the housing market he is also a prophet. When housing prices started to skyrocket in 2003, he published The Coming Crash in the Housing Market correctly warning us that a real estate bubble was forming. Then in January 2006, he called the absolute peak of home prices in the US by releasing a new book, Sell Now! The End of the Housing Bubble.

“Mr. Talbott, the person who accurately predicted the housing bubble and its bust, now has a new prediction – IT IS THE TIME TO BUY A HOME! In a recent article, Homes – Buy Now!, Talbott simply explains:

“I have been waiting for more than five years to offer this advice. It is now time in most cities across the country to buy a new home or refinance your existing home with thirty-year fixed rate mortgage debt.”

“He goes on to explain that his conclusion is based on four different metrics, all of which favor buying today:

- Home Prices Relative to Peak Prices During the Bubble

- Home Prices Relative to Construction Costs or Replacement Costs

- Home Prices Relative to Incomes and Rents

- Home Prices in Real Terms, Not US Dollar Terms

Bottom Line

“If the person who called the real estate bubble and its bust says now is the time to buy, we believe it is time to buy.”