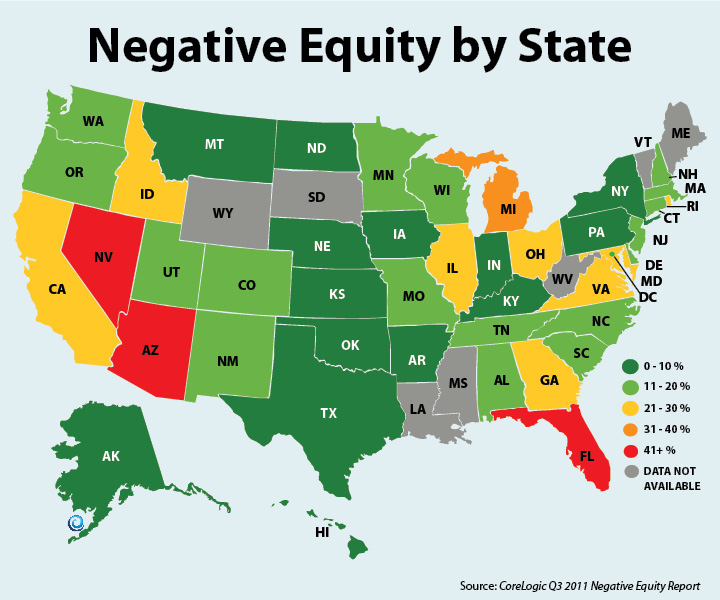

Negative Equity by State

Thanks to our friends at the KCM Blog for this InfoGraphic. Note: This only applies to single family residences. Apartments and multi-family properties are doing terrific, because their values are determined by the income stream which they produce (not comps).

Why the U.S. was Downgraded…

“Why the U.S. was downgraded…

- U.S. Tax revenue: $2,170,000,000,000

- Fed budget: $3,820,000,000,000

- New debt: $ 1,650,000,000,000

- National debt: $14,271,000,000,000

- Recent budget cuts: $ 38,500,000,000

Let’s now remove eight zeros and pretend it’s a household budget…

- Annual family income: $21,700

- Money the family spent: $38,200

- New debt on the credit card: $16,500

- Outstanding balance on the credit card: $142,710

- Total budget cuts: $385 ” – Anonymous

Those glib, self-serving dip-wads in the Congress and Federal Government are killing us. Thanks to Josh Mettle’s Blog for this enlightenment!

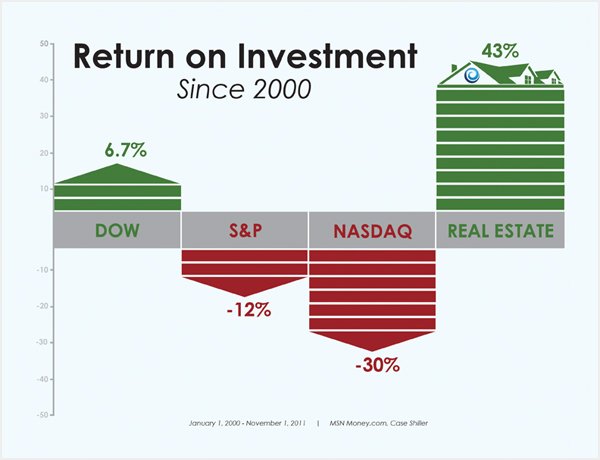

Investors: Heads-up! It’s Time to Buy

Just in case you’re not paying close attention… It’s time to buy!

Just in case you’re not paying close attention… It’s time to buy!

Here’s some evidence:

Steve Sjuggerud’s Daily Wealth: Those Fools… The Housing Bust is OVER

“In America, the bursting of the housing bubble isn’t halfway over. It’s COMPLETELY over.”

Steve Sjuggerud’s Daily Wealth: You Don’t Believe My Housing Argument? Here’s Proof…

“Right now is the moment to make your deal. The time for extraordinary deals like this will pass… quicker than you think.”

Wall Street Journal: It’s Time to Buy That House

“[W]hen mortgage rates are taken into consideration, houses are the most affordable they have been in decades.”

MarketWatch.com: Now Might Be the Best Time Ever to Buy a Home

“[R]ents remain sky-high in the U.S. right now, and in many markets it’s actually cheaper to buy a home than rent a two-bedroom apartment.”

AG Beat: The state of long term real estate investing – the perfect storm is here

“If you have the wherewithal to invest now, do it. Do it wisely, but do it now.”

JP Morgan Market Insights: Housing: A Time To Buy

“[T]he numbers tell us it is a time to buy.”

Best Articles: The Housing Bust is Over

“You may be surprised to hear it, but thanks to lower mortgage rates and lower home prices, homes are affordable… They’re just as affordable now as they were right before they boomed in the 2000s.”

I’ll be out inspecting property and making offers on January 2nd. Hope to run into you! 🙂

“For Landlords, This Could Be The Perfect Storm”

My son and investment partner, Josh Mettle, publishes an exceptional Mortgage Blog as well as a print newsletter. In the Spring issue of his print newsletter, he said something very important for landlords that I want to share here:

My son and investment partner, Josh Mettle, publishes an exceptional Mortgage Blog as well as a print newsletter. In the Spring issue of his print newsletter, he said something very important for landlords that I want to share here:

“…I should mention that rental properties are about as good a hedge against inflation as you can possibly get. I’m personally getting pretty nervous about the money printing and inflationary actions of the Federal Reserve. One of the first things that goes up in an inflationary environment is rent and, as a landlord, you have the benefit of making your fixed mortgage payment as you steadily keep raising rents to keep up with inflation.

We also have a very unique and pro-landlord situation brewing today as many people’s credit has been damaged and many others have just been convinced by the media that it might just be better to rent. I personally think that is a bad decision, but for landlords this could be the perfect storm. More…