“U.S. Housing is the Next Gold”

Dr. Steve Sjuggerud says that real assets are better than gold now. As real estate investors, we already know that. But now the cat is out of the bag! Read his blog post to get the scoop.

More Good News for Landlords

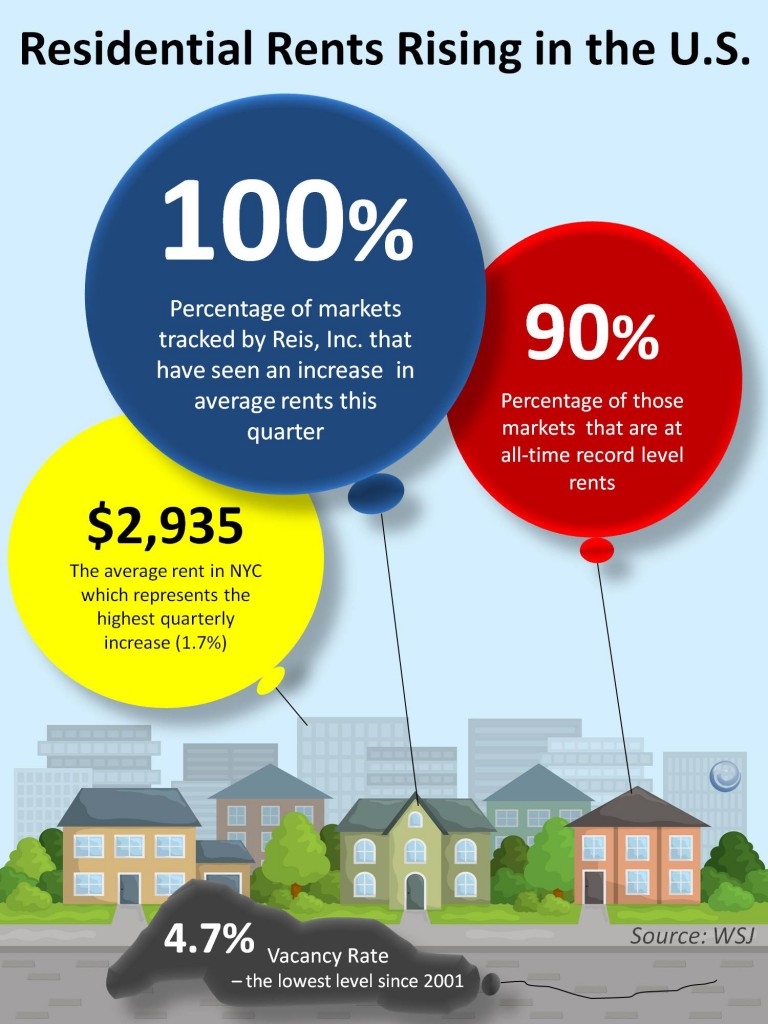

This great new info-graphic from our friends at The KCM Blog shows visually that landlords are getting special again.

This great new info-graphic from our friends at The KCM Blog shows visually that landlords are getting special again.

100% of markets tracked saw an increase in rents this quarter.

As landlords, we go through periods where we don’t feel very special (the recent recessionary years come to mind).

And then we have periods when we feel very special…when rents are rising and units fill fast (and banks lend us money)!

I signed leases with highest-ever rents on 6 different properties in the past month – both homes and apartments.

There were feeding-frenzies with multiple applicants on each of those properties. The feeding-frenzies repeated even though I made pretty big rent increases on all the homes and apartments that turned over.

Several times I had to take the ads down within 24-48 hours of posting to get the phone to quit ringing.

I figured the rents must be too low.

Each time the feeding-frenzie happened, I re-researched the market and raised the rents again.

This is a great problem 🙂

Are we at the bottom yet?

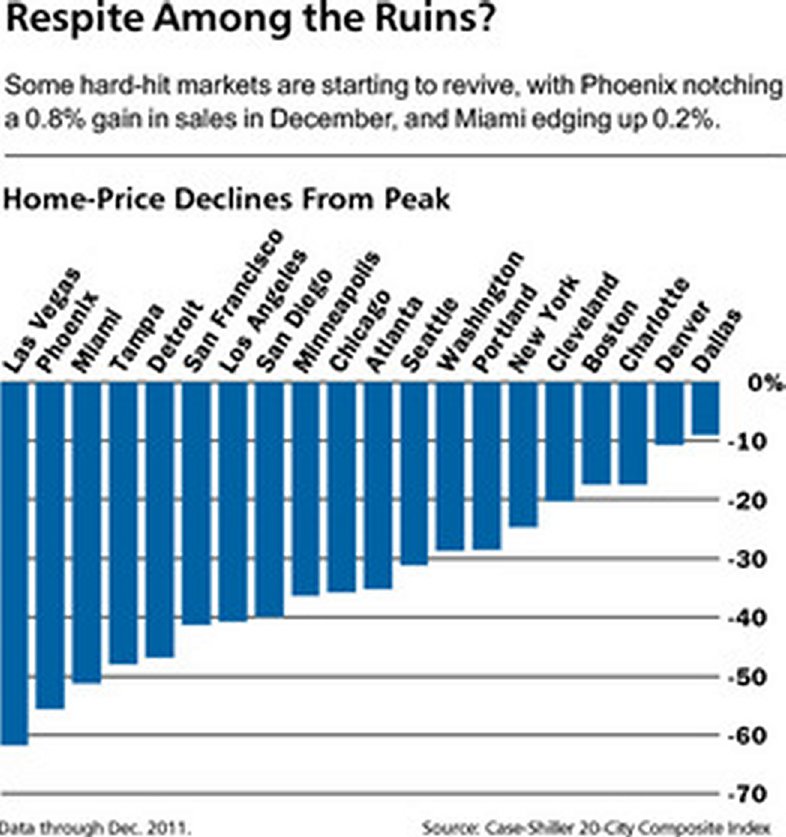

Read this interesting Barrons article from a real estate investor’s point of view. Investors want to buy at the bottom and hold for the rocket ride. We all suffer from that delicious fantasy. We all have sad stories of buying too late and selling too soon. But fantasy is “imagination unrestricted by reality.” So, rub your eyes and pay close attention to all the recovery indicators in the real estate market.

Read this interesting Barrons article from a real estate investor’s point of view. Investors want to buy at the bottom and hold for the rocket ride. We all suffer from that delicious fantasy. We all have sad stories of buying too late and selling too soon. But fantasy is “imagination unrestricted by reality.” So, rub your eyes and pay close attention to all the recovery indicators in the real estate market.

Good News for Landlords

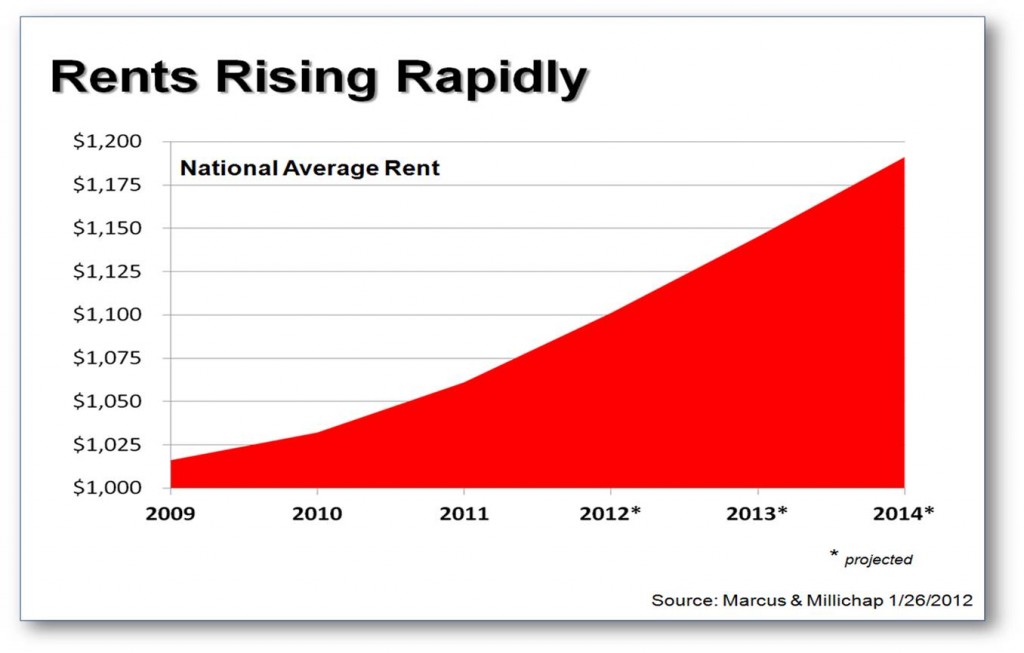

The KCM Blog just posted this happy graph, showing average national rent increases over the past three years and projected rent increases over the next three years based on a report from Marcus & Millichap.

The KCM Blog just posted this happy graph, showing average national rent increases over the past three years and projected rent increases over the next three years based on a report from Marcus & Millichap.

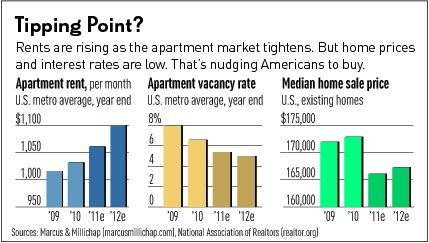

On the other hand, a recent Investor’s Business Daily article opines that high apartment rents are pushing renters to buy homes.

On the other hand, a recent Investor’s Business Daily article opines that high apartment rents are pushing renters to buy homes.

But fear not, because “more renters are on the way.” Supply and demand is on our side. There are a large number of echo boomers age 20 – 34 entering the rental market which are likely to make up for those who leave it.

All of this is terrific news for income property investors!

Investors: Heads-up! It’s Time to Buy

Just in case you’re not paying close attention… It’s time to buy!

Just in case you’re not paying close attention… It’s time to buy!

Here’s some evidence:

Steve Sjuggerud’s Daily Wealth: Those Fools… The Housing Bust is OVER

“In America, the bursting of the housing bubble isn’t halfway over. It’s COMPLETELY over.”

Steve Sjuggerud’s Daily Wealth: You Don’t Believe My Housing Argument? Here’s Proof…

“Right now is the moment to make your deal. The time for extraordinary deals like this will pass… quicker than you think.”

Wall Street Journal: It’s Time to Buy That House

“[W]hen mortgage rates are taken into consideration, houses are the most affordable they have been in decades.”

MarketWatch.com: Now Might Be the Best Time Ever to Buy a Home

“[R]ents remain sky-high in the U.S. right now, and in many markets it’s actually cheaper to buy a home than rent a two-bedroom apartment.”

AG Beat: The state of long term real estate investing – the perfect storm is here

“If you have the wherewithal to invest now, do it. Do it wisely, but do it now.”

JP Morgan Market Insights: Housing: A Time To Buy

“[T]he numbers tell us it is a time to buy.”

Best Articles: The Housing Bust is Over

“You may be surprised to hear it, but thanks to lower mortgage rates and lower home prices, homes are affordable… They’re just as affordable now as they were right before they boomed in the 2000s.”

I’ll be out inspecting property and making offers on January 2nd. Hope to run into you! 🙂