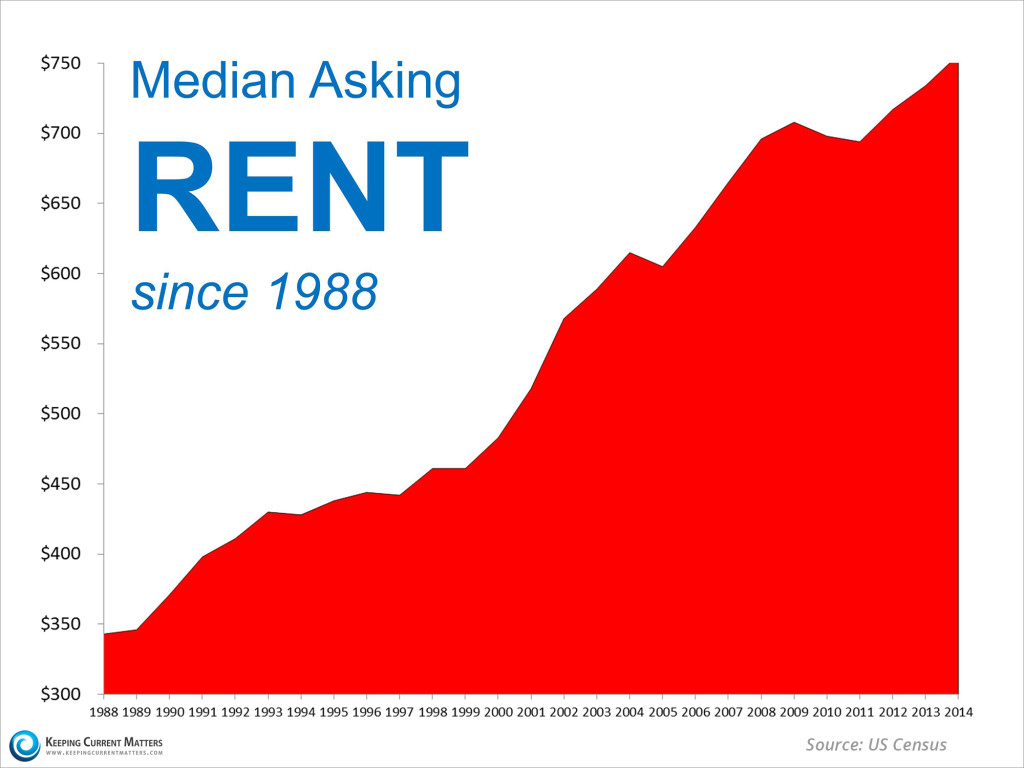

Rents are Climbing!

Here’s a chart showing U.S. rent increases over the last 25 years. This is not a big surprise for any income property investor, but dang that chart is pretty impressive! Read the details at the KCM Blog.

Highest Ever Rents Banked in 2014

A stunning $441 Billion was banked in rents in the U.S. in 2014, according to our friends at the KCM Blog. This is a $20 Billion increase over the year before.

Zillow’s Chief Economist predicts that 2015 will be more of the same.

Read the whole story at the KCM Blog.

Photo credit: mcfcrandall via photopin cc

Are Your Tenants’ Candles Burning up Your Profits?

A couple of years ago we had three apartments turnover, all about the same time, and they all had a sort of black soot on the walls and ceilings that made the apartments look dark and dingy and depressing.

I was standing in one of the apartments with my mouth open, and my maintenance contractor said: “they must have been burning candles 24-7.” He then showed me that the soot couldn’t be washed off…it had to be repainted. Ugh.

This can be a big expense for landlords, and forces you to keep the apartment off the market longer to get painting done. So here’s a great solution to cut this damage off at the pass:

Promote soy wax candles to your tenants!

Here’s how green and sexy soy wax candles are:

- Paraffin candles are petroleum-based products. They are full of toxic chemicals and additives, and they are unhealthy to breathe. They leave an icky black soot on the walls and ceilings of living spaces, and in your lungs.

- Soy candles are biodegradable, are non-toxic, are made with renewable energy resources, burn 30-50% longer, are healthy to breathe, and don’t leave soot and residue on the walls.

- Soybeans are part of the world’s sustainable agriculture program, so you’ll be investing in a valuable product that is helping the environment.

- Many soy candles are beautifully hand crafted by small American businesses and come in a large variety of appealing aromas.

I now attach a written info sheet to each new lease, and I pitch each new tenant on the joys of soy candles.

Lemons to lemonade.

Soy candles are available at Whole Foods and Amazon dot com.

“No Vacancies” A Landlord’s Favorite Words

One thing you can count on in business (and in life) is change…so I thought I better show off real quick before something changes.

To start off this new year, we have 87 apartments with No Vacancies!!

I can’t even remember the last time that happened.

We do have one vacant house…but houses are a different business in our world so I can brag about the apartments separately. (That’s my story and I’m sticking to it.)

We had huge turnover last summer. We decided it was a perfect time to sell a few houses, so we asked a few long term month-to-month tenants to leave for that purpose. Then suddenly we had some other long term tenants give us notices. Gulp.

At one point last summer we had 8 vacant houses. Eight.

Plus normal spring and summer apartment turnover.

So I was one stressed out lady when the cash/bills graphs got crossed (bills up, cash down). Filling vacancies is always my absolute top priority, so I had little time to blog. I’ll try to get in a little pontificating now.

Josh and I would like to add a new apartment complex this year, so I probably won’t be basking in the No Vacancies glow for long 🙂

Tell Your Tenants: DO NOT TURN OFF THE HEAT!

Be sure to tell your tenants: PLEASE DO NOT TURN YOUR FURNACE OFF OR WAY DOWN during this very cold weather!

Be sure to tell your tenants: PLEASE DO NOT TURN YOUR FURNACE OFF OR WAY DOWN during this very cold weather!

It’s amazing (and embarassing) that landlords would have to tell their tenants not to turn off their heat when the weather is freezing, but you may as well learn from our mistakes so you don’t have to suffer what we just went through:

We just had residents on two different properties cause severe and costly damage to the property by turning off their heat “to save money.”

In one apartment, they turned off the heat to save money over the holidays while they were out of town. When they got back in town they called to say that they had no water and their tub drain was backed up…..as in frozen solid! It took our maintenance contractor about five hours to get the pipes unfrozen.

In another apartment, the tenants also turned off their heat over the holidays to save money because they were out of town. When they got back we found out that every single appliance had been frozen and had to be replaced: the water heater, the dishwasher, the garbage disposal and the furnace all were frozen and failed. The cost? Approximately $3,000.00 so these tenants could save maybe $30.00 in heat costs over the holidays. (By the way, the boyfriend had the chutzpah to call and tell us what crappy landlords we were for renting an apartment with all the appliances dead and dying).

Last year we had a tenant who complained that her walls and windows were sweating and causing water damage. Our maintenance contractor found out that she was turning her heat off in the day time while she went to work to save money. This caused the walls and windows to condensate and “sweat” when she came home each night and turned the heat on because the walls the windows were ice cold.

Last year we had another couple who turned their heat down as low as it could go every day when they went to work. Then they would call and complain repeatedly that there was something wrong with their furnace because it kept shutting off. We had several furnace experts come out and inspect the furnace at high costs. The experts figured out that the furnace’s safety mechanism was repeatedly shutting the furnace down because it was working so hard to reheat the apartment that it was overheating itself.

Hopefully, this will help you learn vicariously from our misadventures!

Warren Buffet Digs Real Estate

Our favorite 82-year old mid-western billionaire is sweet on real estate. Whodathunkit?

Our favorite 82-year old mid-western billionaire is sweet on real estate. Whodathunkit?

Warren Buffet just branded “Berkshire Hathaway HomeServices.” This new real estate franchise will be operational in 2013.

It looks like he’s positioning his new company front and center of the real estate recovery.

Get ready for the rocket ride!

Read more about it at the KCM Blog and Bloomberg.

Fannie Mae Expands Investor Financing Options

Hey real estate investors…have you ever wondered when your bailout would come along? Well this may help out:

Hey real estate investors…have you ever wondered when your bailout would come along? Well this may help out:

“Fannie Mae recently announced expansion of it’s Homepath Mortgage product that provides home buyers and investors financing for the purchase of Fannie Mae-owned properties.

The new product will allow eligible individual and LLC borrowers to finance up to 20 properties using the Homepath Mortgage. NAR has long called for expansion of financing opportunities for investors as a way to increase the absorbtion of REO properties. Fannie Mae will offer flexible lending terms and will not require appraisals of the properties.

Visit Homepath.com for more information on the program and participating lenders.”

Thanks to the National Association of Realtors for this heads-up and for their smart advocacy.

2012 started with a fish taco attack in San Diego…

I had a fish taco attack when our plane landed in San Diego at noon on Christmas eve. Josh and Hillary gave me a new iPhone 4S, so we asked Siri for the best fish taco place in San Diego. She gave us the top 14 fish taco restaurants in order of popularity by customer ratings, and we spent the next ten days in search of the perfect fish taco. It was a great and tasty adventure! We had my little grandkids Zander and Aria with us, so we relaxed and did lots of kid stuff and lots of walking. We hit the zoo twice, the wild animal park, Sea World, the beach, fabulous sunsets, the works.

I had a fish taco attack when our plane landed in San Diego at noon on Christmas eve. Josh and Hillary gave me a new iPhone 4S, so we asked Siri for the best fish taco place in San Diego. She gave us the top 14 fish taco restaurants in order of popularity by customer ratings, and we spent the next ten days in search of the perfect fish taco. It was a great and tasty adventure! We had my little grandkids Zander and Aria with us, so we relaxed and did lots of kid stuff and lots of walking. We hit the zoo twice, the wild animal park, Sea World, the beach, fabulous sunsets, the works.

2011 was our best year ever! We worked smarter, and got leaner and meaner. We think 2012 will be a great year to increase and add cash flows. We have several plans in the works and will keep you informed as we pull them off. The landlording business is a ton of fun and a great retirement gig. I hope you have as much fun this year as I’m having!

When the Prophet Says Buy — BUY!

Investors, if you are watching the market closely to determine if it’s time to buy: head’s up! Here’s another killer post from our friends at The KCM Blog that is a must read:

Investors, if you are watching the market closely to determine if it’s time to buy: head’s up! Here’s another killer post from our friends at The KCM Blog that is a must read:

“John R. Talbott, previously a Goldman Sachs investment banker, is a bestselling author and economic consultant. When it comes to the housing market he is also a prophet. When housing prices started to skyrocket in 2003, he published The Coming Crash in the Housing Market correctly warning us that a real estate bubble was forming. Then in January 2006, he called the absolute peak of home prices in the US by releasing a new book, Sell Now! The End of the Housing Bubble.

“Mr. Talbott, the person who accurately predicted the housing bubble and its bust, now has a new prediction – IT IS THE TIME TO BUY A HOME! In a recent article, Homes – Buy Now!, Talbott simply explains:

“I have been waiting for more than five years to offer this advice. It is now time in most cities across the country to buy a new home or refinance your existing home with thirty-year fixed rate mortgage debt.”

“He goes on to explain that his conclusion is based on four different metrics, all of which favor buying today:

- Home Prices Relative to Peak Prices During the Bubble

- Home Prices Relative to Construction Costs or Replacement Costs

- Home Prices Relative to Incomes and Rents

- Home Prices in Real Terms, Not US Dollar Terms

Bottom Line

“If the person who called the real estate bubble and its bust says now is the time to buy, we believe it is time to buy.”

Why the U.S. was Downgraded…

“Why the U.S. was downgraded…

- U.S. Tax revenue: $2,170,000,000,000

- Fed budget: $3,820,000,000,000

- New debt: $ 1,650,000,000,000

- National debt: $14,271,000,000,000

- Recent budget cuts: $ 38,500,000,000

Let’s now remove eight zeros and pretend it’s a household budget…

- Annual family income: $21,700

- Money the family spent: $38,200

- New debt on the credit card: $16,500

- Outstanding balance on the credit card: $142,710

- Total budget cuts: $385 ” – Anonymous

Those glib, self-serving dip-wads in the Congress and Federal Government are killing us. Thanks to Josh Mettle’s Blog for this enlightenment!