How to Build Passive Income

My son, Josh Mettle, just interviewed me for his Physician Financial Success Podcast on iTunes. I hope you give it a listen while you’re walking your dog, hiking or traveling up the coast 🙂 You will learn (among other things):

- The kind of stuff they never teach you in real estate school.

- What I learned from Donald Trump about picking up great properties.

- How to bootstrap your way into income property investment.

- How to weather the storm when markets move from good to bad to good again.

- How to retire with cash flow.

- How to start!

If you have a secret desire to bridge from the billable hour to passive income for life, this may help you get started. Enjoy!

Advice for Tenants

A tenant asked me today why I didn’t have any advice for tenants at my blog. That kind of stumped me, because this blog is for landlords.

But I actually do have some very important advice for tenants: Buy a home. Do it now. Don’t wait.

Interest rates are going up, and you’ll be able to buy less and less home in the future because of the higher cost of money.

You’re welcome.

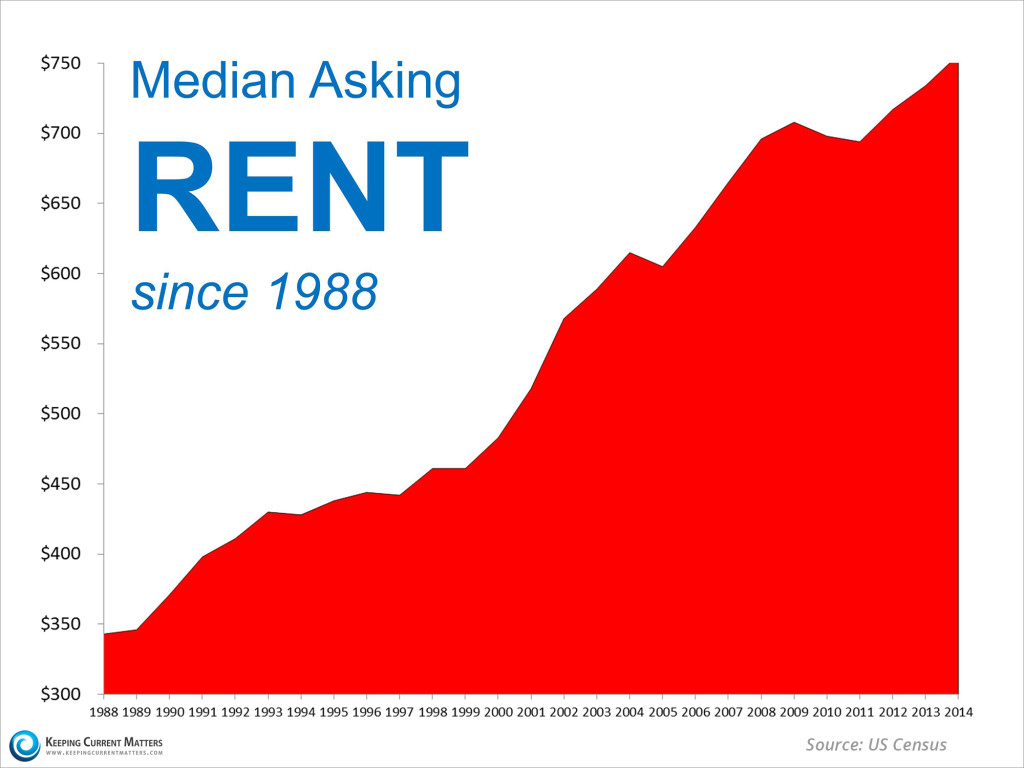

Rents are Climbing!

Here’s a chart showing U.S. rent increases over the last 25 years. This is not a big surprise for any income property investor, but dang that chart is pretty impressive! Read the details at the KCM Blog.

Highest Ever Rents Banked in 2014

A stunning $441 Billion was banked in rents in the U.S. in 2014, according to our friends at the KCM Blog. This is a $20 Billion increase over the year before.

Zillow’s Chief Economist predicts that 2015 will be more of the same.

Read the whole story at the KCM Blog.

Photo credit: mcfcrandall via photopin cc

What is Possible in 2015?

One of the main things that sets you aside as a landlord, real estate investor and entrepreneur, is that you have vision. You create new futures, new goals, new, renewed and improved properties, beautiful environments and other happy living circumstances. You are a leader.

Most people only see what’s in front of them. Most people find it difficult to envision a future that is not already there.

Entrepreneurs see things that are not there yet and then make them come into being.

Here’s a couple of examples from my own family:

My Dad was always considered a “wild man” because (among other things) he believed in his visions of the future and took big risks to make them happen.

Dad never waited for permission, agreement or approval.

He used to drive through Kanab, Utah on his way to boat at Lake Powell or vacation in Phoenix. Dad just loved the Kanab town and red sand.

So he bought 500+ acres of it.

Our family all thought he was out of his mind. My Mom actually went on strike for a couple of years.

The people in Kanab thought that the sage brush and red sand was only good for grazing cattle.

But Dad envisioned a bridge across the river, a beautiful subdivision of acre-plus ranchettes and his very own “No Bull Ranch” with three canyons backed up to BLM land that goes forever.

And that’s what exists there now.

Before that, Dad had a landscaping business and a nursery on a few acres in West Valley City, Utah. So naturally, he decided to bulldoze it and build 90 apartment units.

One day Dad was out on his tractor grading the land in preparation for building, when a black limo pulled up out front and a man inside asked one of Dad’s workmen where the owner was. The workman pointed to Dad on the tractor, and the man from Aetna said “give him the loan.” (This actually happened in the real world!)

Entrepreneurs have vision, and the leadership to make that vision come into existence.

My inspiration for this New Year 2015 post was a podcast I just listened to by Eben Pagan. Eben says:

“As an entrepreneurial leader you are the keeper of a very special flame — the vision of a better future…. As the leader, your ability to envision a better future and then translate that vision to others is priceless.”

Eben also points out that it’s key to keep believing in yourself and the future you envision:

“Even. When. Other. People. Don’t.”

[By the way, if you haven’t subscribed to Eben’s podcasts you are missing out on some wonderful entrepreneurial leadership that will inspire you to grow your business to the next level in 2015. I highly recommend it.]

Remember this quote from Steve Jobs?

“A lot of times, people don’t know what they want until you show it to them.”

Could there be any better example of leadership and entrepreneurial vision than Steve Jobs?

So let’s make this personal. What can we envision in 2015:

- That would enhance the lives of our tenants?

- That would enlarge our cash flows?

- That would improve the value of our property?

- That would contribute positively to the neighborhood?

- That would build our business and our estate?

- That would “put a dent in the universe?” (Steve Jobs)

I don’t know about you, but I have a lot of work to do!

So here’s to you and me having some wonderful visions of a better future in 2015. Let’s get out there and bring them into existence.

How to be Smart in a World of Dumb Landlords

Last week I told a tenant: “I am not your mother, father, bishop, priest, pastor, social worker or shrink.”

The tenant was shocked. But that stopped the gossip right there in its tracks.

She and her husband had been my great tenants for six years. They always paid their rent on time and were lovely people. Now they were splitting up, and both wanted to hurt the other by telling their landlord bad things.

I said “you guys need to knock it off. I want to remember the good things about you so I can give you a great reference when you need it in the future.” Uh, they hadn’t thought about that.

Can I be painfully honest with you for a moment?

Not the “you have spinach in your teeth” type of honesty, but the brutal, painful, your business will never improve until you get this, kind of honesty.

So here it is.

You have to run your rental property like a business. If you already run your units like a professional, you can be excused from this “Come to Jesus” meeting. The rest of you, please listen up.

In the old Wild West, every railroad worker wore a different uniform and a different hat: Conductors, Engineers, Firemen, Brakemen, Flagmen, Porters, etc. This made it easy to identify their different jobs.

Borrowing from that tradition, consider each different job you have as a different “hat.” You are probably a mother, father, daughter, son, volunteer, cook, cleaner, chauffeur, coach, possibly a professional, and if you’re reading this blog post you’re probably also a landlord.

Whatever job you’re doing, consider the “hat” you’re wearing at that instant. If you confuse your hats, you can get in trouble. And some tenants will try to suck you into their drama to throw you off and get you to wear the wrong hat.

One of the best examples of this is a prospective tenant who doesn’t qualify to rent your unit. This person knows that they will be homeless or living in a relative’s basement unless they can find a landlord who will buy their “story” instead of actual qualifications. This unqualified tenant will want you to wear something like a social worker hat instead of a landlord hat when you are deciding whether they qualify for your units. Guaranteed, they have a hard luck story to beat all hard luck stories. And if you succumb, you will get the unqualified tenant (and the legal fees, rent loss and other expenses that come with unqualified tenants.)

When I was practicing law for landlord clients, I once evicted “Utah’s Most Wanted” criminal. Scary. But how did that man become a tenant of that property? The landlord was not running his property like a business, because the tenant obviously didn’t begin to qualify. That landlord was not wearing his “landlord hat.”

Likewise, if you accept a “story” instead of on-time rent payments, you are not running your rental property like a business. I have often been shocked at how long a landlord will allow a non-paying tenant to go on story-telling instead of serving a polite, professional, pay or quit notice with a smile. Put on that “landlord hat.”

And by the way, I can tell you this from long experience as both an attorney and a landlord, that the longer you allow a non-paying tenant to keep possession of your unit, the harder they will fight to stay there, and the higher your legal fees will eventually be.

Just saying.

Look, here’s the truth: landlords that run their rental property like a business are just plain smarter. And they make a lot more money.

The good news is that it’s relatively easy to gain the same kind of smarts as the landlords with fat pockets. So here’s some tips:

- Every landlord in the known universe should go to their local Apartment Association and take the Good Landlord classes and the Landlord 101 class. Don’t argue with me about this, just drag yourself down there and do it right away.

- Join the Apartment Association, and get access to their forms, their advice, and their service providers. This will save you over and over, especially in a weak moment.

- Read and read some more. If you’re relying on old knowledge, you’ll be obsolete in no time. Keep up.

- Hang out with interesting, smart landlords who are socking away for their retirement and let them rub off on you. (You can find them at the Good Landlord classes 🙂

You’ll still be you. But you’ll be a better, smarter, version of you — with a great rental property business and lovely tenants.

Now go forth, get smart, and make a profit!

Photo credit: electricnerve via photopin cc

2014 Residential Rental Market Survey

National Apartment AssociationUnits Magazine, September 2014

“2014 will likely go down as the formal beginning of the shift to a renter-based society.”

Thus sayeth the National Apartment Association in the September 2014 issue of Units Magazine.

Great for investors.

Not great for our kids and grandkids.

The Power of the Word “No”

When I was a youngster, I had the great opportunity of working for a famous best-selling writer.

He took big risks on me and put me in charge of a series of important projects – including flying me to Kingsport, Tennessee to publish one of his books at the tender age of 22.

Then he put me in charge of renovating a big hotel in Florida, and then half a million sq. ft. of office space in Los Angeles. I had hundreds of people under my charge and I was 23. (He once told his son-in-law “if you need a miracle, send Cynthia.”)

But the biggest risk he took was when he put me in charge of the PO (purchase order) line. In other words, if I signed off on a renovations expense – the check issued. The dude was a risk-taker.

But it was a calculated risk. Before I got the power to sign POs, he made me stand in front of a mirror with a witness for one hour and say “NO.”

That seemed kind of fun for about five minutes.

After that I had to get creative. Have you ever considered how many ways there are to say “no?” There’s Shakespeare “no,” Bible “no,” Beatles “no,” Rolling Stones “no,” big meanie “no,” nice “no,” cheerful “no,” angry “no,” conservative “no,” enthusiastic “no,” hear no evil, see no evil, speak no evil. You get the idea.

At the end of the “No” drill, no was just no. It didn’t come with a bunch of baggage and mis-emotion. It wasn’t necessarily tyrannical or oppressive. It didn’t immediately cause a reaction in me or the people I dealt with. I also learned that you can actually say no without using the word. For example, you can say not okay or not approved.

Over the years, and especially in business, I’ve learned that when you say no, if you go on to kindly educate the person as to why – they will often thank you. I am repeatedly surprised when I get thanked for saying no.

For instance, I probably get one or two requests every month to let a tenant out of their lease.

I explain that the bank has to rely on me to collect the rents each month so that their mortgage gets paid, and the property is kept up. Likewise, I have to rely on good qualified tenants to keep their contracts and pay their rents so I can keep my contract with the bank and our service providers. If we let everyone out of their lease when it was inconvenient for them to fulfill their contract, we wouldn’t even have a business.

Plus, I’m required by law to treat all of our tenants the same, so if I let one person out of their lease I have to let everyone out of their lease or I may get in discrimination trouble which could carry a $10K fine.

That’s the bad news. The good news is that I will work like a mad woman to re-rent their unit as fast as possible to mitigate the damages.

Tenants appreciate it when you explain the business reason why their request is not approved.

Every once in a while if a tenant gets belligerent (which happened recently when a tenant’s boyfriend tried to verbally rough me up) I might get snarky and say “what you’re really saying to me is ‘hey I want to break my lease and I don’t want to suck up the costs of my actions, so I want you to suck up the costs of my actions. And if you say no you’re just a big meanie yucky landlord.’”

That usually ends the conversation.

Here’s a horrible example of some landlords that couldn’t say no:

When I was practicing law an adult daughter hauled her parents into my office under protest. The parents (I’m guessing in their mid-70s) had a young family living in their rental house that hadn’t paid rent for years. Years. (I’ll save you from the giant convoluted stories that the landlords bought instead of collecting rent.)

The retired landlord had gone back to work so he could pay the mortgage on the rental house because the young family wasn’t paying rent.

That was a landlord that could not say no. It was easier to go back to work than to confront the deadbeats and say nyet.

You can’t be successful in business unless you have the ability to say and hear the word no. Learn to use it and succeed.

[Photo credit: christopherdale via photopin cc ]

How to Build Passive Income Streams

My son and investment partner, Josh Mettle, has a new podcast: Physician Financial Success, which teaches physicians how to avoid financial landmines. Dr. David Phelps teaches professionals how to stop trading time for dollars and transition from earned income to passive income. The two of them got together for this really great podcast.

I’m a “retired” attorney, which makes me kind of an odd bird. When I got ready to retire, I then had a full time crazy-busy law practice and I co-owned and self-managed 70 houses and apartment units in my “spare time” with the help of my daughter-in-law. I called the Bar and asked if there was some kind of a checklist or roadmap for how to wrap up a practice and retire. Apparently, attorneys don’t retire, they just have heart attacks and die. I wanted to skip that part! So I had to invent my own off-ramp.

Dr. David Phelps seems to have systemized it.

If you have a secret desire to transition from the billable hour to passive income, it’s worth 30 minutes to listen to these two smart investors discuss the process.

It’s like dessert without the calories!

P.S. You can sign up for Josh’s new podcast at iTunes if you want to hear more great investment advice while you walk your dog or commute to work 🙂

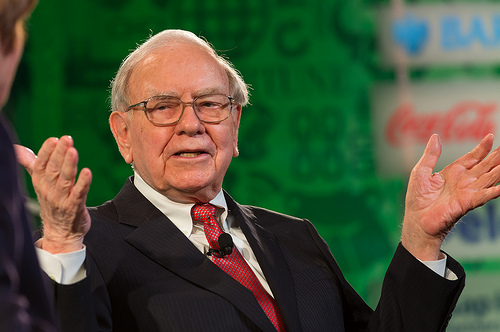

Buffett’s annual letter: What you can learn from my real estate investments

When Warren Buffett pontificates on two of his real estate investments, I think we should pause and pay attention. In this case, the real estate tutorial comes in the annual letter to Buffett’s shareholders!

When Warren Buffett pontificates on two of his real estate investments, I think we should pause and pay attention. In this case, the real estate tutorial comes in the annual letter to Buffett’s shareholders!

My son/partner Josh sent this to me and I think we both had slightly different takeaways. What impressed me is Buffett’s focus on his estimate of the future earnings of the assets when he considered their purchase, not the future value. (Josh is a numbers guy, and he’s going to write about his impressions of Buffett’s article in his monthly newsletter, so I’ll be interested in how his takeaways differ from mine.)

Future earnings. Not future value.

That’s easy on commercial properties, because the value of the property is determined by the income stream that it produces. So you can put all of your attention on increasing the income stream knowing that you are increasing value simultaneously. But homes are valued by comparables, they require a different discipline.

Having just lived through a recession as a landlord and real estate investor, I can tell you that we survived it because of the earnings from our investments. Cash flow saved us and got us through and in a stronger position than before the recession. We didn’t dwell on values because as long as we had positive cash flow, we were in a good position.

Please get a nice cup of your favorite beverage and take a few minutes to ponder Buffett’s message and it’s lesson for real estate investors:

Buffett’s annual letter: What you can learn from my real estate investments

By Warren Buffett

“Investment is most intelligent when it is most businesslike.” –Benjamin Graham, The Intelligent Investor

It is fitting to have a Ben Graham quote open this essay because I owe so much of what I know about investing to him. I will talk more about Ben a bit later, and I will even sooner talk about common stocks. But let me first tell you about two small nonstock investments that I made long ago. Though neither changed my net worth by much, they are instructive.

This tale begins in Nebraska. From 1973 to 1981, the Midwest experienced an explosion in farm prices, caused by a widespread belief that runaway inflation was coming and fueled by the lending policies of small rural banks. Then the bubble burst, bringing price declines of 50% or more that devastated both leveraged farmers and their lenders. Five times as many Iowa and Nebraska banks failed in that bubble’s aftermath as in our recent Great Recession.

In 1986, I purchased a 400-acre farm, located 50 miles north of Omaha, from the FDIC. It cost me $280,000, considerably less than what a failed bank had lent against the farm a few years earlier. I knew nothing about operating a farm. But I have a son who loves farming, and I learned from him both how many bushels of corn and soybeans the farm would produce and what the operating expenses would be. From these estimates, I calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity would improve over time and that crop prices would move higher as well. Both expectations proved out.

I needed no unusual knowledge or intelligence to conclude that the investment had no downside and potentially had substantial upside. There would, of course, be the occasional bad crop, and prices would sometimes disappoint. But so what? There would be some unusually good years as well, and I would never be under any pressure to sell the property. Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid. I still know nothing about farming and recently made just my second visit to the farm. More…