Fund Your Fabulous Retirement with Cash Flow from Rental Property

Recently, I got an email that went something like: “Sure, right, easy for you to say. You can buy rental property because you have a law degree and money and credit.”

Recently, I got an email that went something like: “Sure, right, easy for you to say. You can buy rental property because you have a law degree and money and credit.”

Huh?

Let me just say, that when I started investing in real estate with my son, I was fresh out of law school with huge student debt, in my mid-40s, no money, no time, no retirement plan, and barely any credit. Plus, I had just finished a 14 year stint as a single-mom.

Yep, I was really special.

We made only a tiny bit of profit on our first investment, after investing a whole summer of work. (We made the mistake of trying to be flippers. Now that I think of it, that was only one of a huge number of mistakes!)

We went negative on our second investment, a condo, which went down in value about $25K the first year we owned it because of a ton of foreclosures in that development. The condo is now worth double what we paid for it with a nice positive cash flow.

On our third investment, an eight-plex (which we had no business buying), we found out at the last minute after investing $15,000.00 earnest money, $3500+ for an appraisal and inspections, etc., that we couldn’t qualify for the loan. I wasn’t willing to walk away, so I broke down and begged a relative for the loan. It was horribly embarrassing. The relative gave us the loan and took a first position lien (because the property was a good investment) at a whopping 8.5% interest. We had no track record, so we paid through the nose for the first three years that we owned that property. My son and I did all the work (in our spare time after hours and weekends) for the first three years. Plus it was negative cash flow and Josh and I had to work to feed the creditors. (Please don’t follow this example!) After that we were able to refinance at 6.5% interest and we finally had positive cash flow. Today, 8.5 years after the purchase, the property is worth twice what we paid for it and we are currently refinancing for about 3.85%. Booya! Now we’re talking cash flow.

So don’t be a big stinking crybaby! (To paraphrase Donald Trump.)

Let me tell you what is way more valuable than money or credit. It’s the burning DESIRE, the drive, the motivation to be successful, to win, to be self-made. This is the entry ticket to the game. If you have this great desire, it’s game on.

You are going to make mistakes. You will sometimes lose money. You will experience frustration and aggravation and nasty little punks that get all up in your face. You will start out working long hours. You won’t know how to do a thousand things.

But over time, you will experience pride and accomplishment. You will have a ton of fun making things look great and renting it to nice people, and you will fund your fabulous retirement before you know it.

You may have to be creative, especially to start. But if you actively look and actively make offers, suddenly you’ll find a property and a situation that will click.

Now get out there with a smile on your face and put together a great retirement…one cash-flowing rental property at a time!

The Greatest Opportunity Ever Is Just About to Pass You By

Dr. Steve SjuggerudHow much louder can I say this? This moment is the greatest opportunity ever to be an American homebuyer. It is the best moment in history. We may never see opportunity this great in our lifetimes. Time's "a-wasting" actually... You're about to miss the best moment, if you don't get on it, right now. The "V" bottom (as I call it) – where you can get the very best prices – is passing you by as I type.

Don’t miss today’s article by Dr. Steve Sjuggerud! Go there and read it now. Seriously! Do it now.

Don’t miss today’s article by Dr. Steve Sjuggerud! Go there and read it now. Seriously! Do it now.

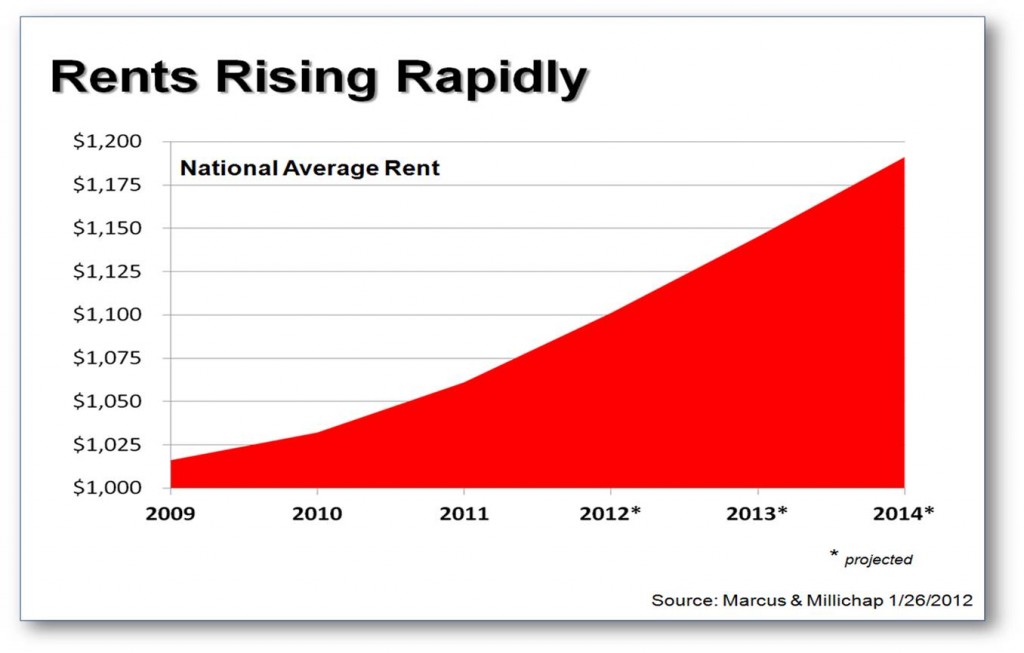

Good News for Landlords

The KCM Blog just posted this happy graph, showing average national rent increases over the past three years and projected rent increases over the next three years based on a report from Marcus & Millichap.

The KCM Blog just posted this happy graph, showing average national rent increases over the past three years and projected rent increases over the next three years based on a report from Marcus & Millichap.

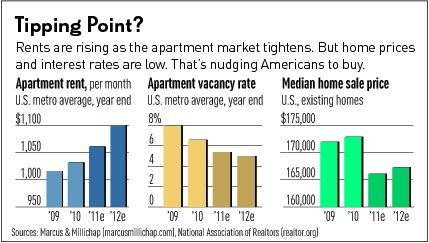

On the other hand, a recent Investor’s Business Daily article opines that high apartment rents are pushing renters to buy homes.

On the other hand, a recent Investor’s Business Daily article opines that high apartment rents are pushing renters to buy homes.

But fear not, because “more renters are on the way.” Supply and demand is on our side. There are a large number of echo boomers age 20 – 34 entering the rental market which are likely to make up for those who leave it.

All of this is terrific news for income property investors!

2012 started with a fish taco attack in San Diego…

I had a fish taco attack when our plane landed in San Diego at noon on Christmas eve. Josh and Hillary gave me a new iPhone 4S, so we asked Siri for the best fish taco place in San Diego. She gave us the top 14 fish taco restaurants in order of popularity by customer ratings, and we spent the next ten days in search of the perfect fish taco. It was a great and tasty adventure! We had my little grandkids Zander and Aria with us, so we relaxed and did lots of kid stuff and lots of walking. We hit the zoo twice, the wild animal park, Sea World, the beach, fabulous sunsets, the works.

I had a fish taco attack when our plane landed in San Diego at noon on Christmas eve. Josh and Hillary gave me a new iPhone 4S, so we asked Siri for the best fish taco place in San Diego. She gave us the top 14 fish taco restaurants in order of popularity by customer ratings, and we spent the next ten days in search of the perfect fish taco. It was a great and tasty adventure! We had my little grandkids Zander and Aria with us, so we relaxed and did lots of kid stuff and lots of walking. We hit the zoo twice, the wild animal park, Sea World, the beach, fabulous sunsets, the works.

2011 was our best year ever! We worked smarter, and got leaner and meaner. We think 2012 will be a great year to increase and add cash flows. We have several plans in the works and will keep you informed as we pull them off. The landlording business is a ton of fun and a great retirement gig. I hope you have as much fun this year as I’m having!

When the Prophet Says Buy — BUY!

Investors, if you are watching the market closely to determine if it’s time to buy: head’s up! Here’s another killer post from our friends at The KCM Blog that is a must read:

Investors, if you are watching the market closely to determine if it’s time to buy: head’s up! Here’s another killer post from our friends at The KCM Blog that is a must read:

“John R. Talbott, previously a Goldman Sachs investment banker, is a bestselling author and economic consultant. When it comes to the housing market he is also a prophet. When housing prices started to skyrocket in 2003, he published The Coming Crash in the Housing Market correctly warning us that a real estate bubble was forming. Then in January 2006, he called the absolute peak of home prices in the US by releasing a new book, Sell Now! The End of the Housing Bubble.

“Mr. Talbott, the person who accurately predicted the housing bubble and its bust, now has a new prediction – IT IS THE TIME TO BUY A HOME! In a recent article, Homes – Buy Now!, Talbott simply explains:

“I have been waiting for more than five years to offer this advice. It is now time in most cities across the country to buy a new home or refinance your existing home with thirty-year fixed rate mortgage debt.”

“He goes on to explain that his conclusion is based on four different metrics, all of which favor buying today:

- Home Prices Relative to Peak Prices During the Bubble

- Home Prices Relative to Construction Costs or Replacement Costs

- Home Prices Relative to Incomes and Rents

- Home Prices in Real Terms, Not US Dollar Terms

Bottom Line

“If the person who called the real estate bubble and its bust says now is the time to buy, we believe it is time to buy.”

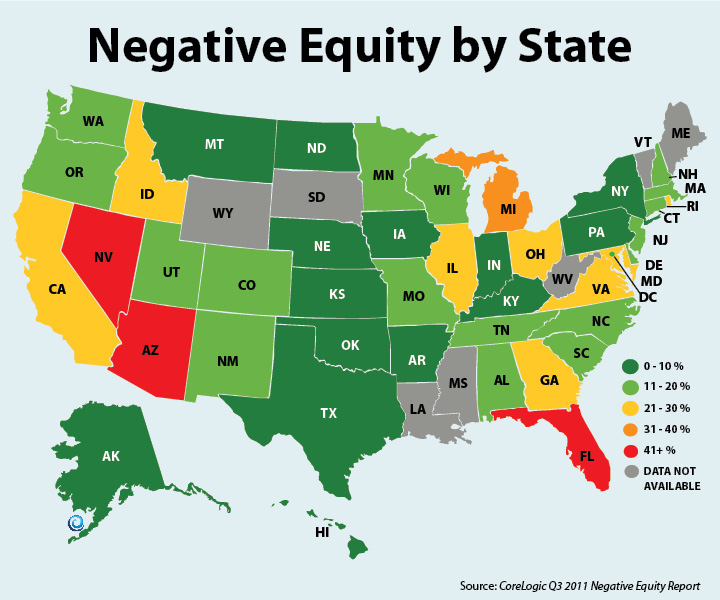

Negative Equity by State

Thanks to our friends at the KCM Blog for this InfoGraphic. Note: This only applies to single family residences. Apartments and multi-family properties are doing terrific, because their values are determined by the income stream which they produce (not comps).

Why the U.S. was Downgraded…

“Why the U.S. was downgraded…

- U.S. Tax revenue: $2,170,000,000,000

- Fed budget: $3,820,000,000,000

- New debt: $ 1,650,000,000,000

- National debt: $14,271,000,000,000

- Recent budget cuts: $ 38,500,000,000

Let’s now remove eight zeros and pretend it’s a household budget…

- Annual family income: $21,700

- Money the family spent: $38,200

- New debt on the credit card: $16,500

- Outstanding balance on the credit card: $142,710

- Total budget cuts: $385 ” – Anonymous

Those glib, self-serving dip-wads in the Congress and Federal Government are killing us. Thanks to Josh Mettle’s Blog for this enlightenment!

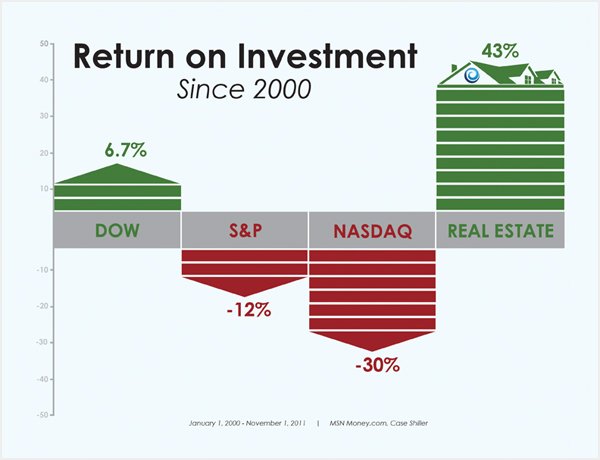

Investors: Heads-up! It’s Time to Buy

Just in case you’re not paying close attention… It’s time to buy!

Just in case you’re not paying close attention… It’s time to buy!

Here’s some evidence:

Steve Sjuggerud’s Daily Wealth: Those Fools… The Housing Bust is OVER

“In America, the bursting of the housing bubble isn’t halfway over. It’s COMPLETELY over.”

Steve Sjuggerud’s Daily Wealth: You Don’t Believe My Housing Argument? Here’s Proof…

“Right now is the moment to make your deal. The time for extraordinary deals like this will pass… quicker than you think.”

Wall Street Journal: It’s Time to Buy That House

“[W]hen mortgage rates are taken into consideration, houses are the most affordable they have been in decades.”

MarketWatch.com: Now Might Be the Best Time Ever to Buy a Home

“[R]ents remain sky-high in the U.S. right now, and in many markets it’s actually cheaper to buy a home than rent a two-bedroom apartment.”

AG Beat: The state of long term real estate investing – the perfect storm is here

“If you have the wherewithal to invest now, do it. Do it wisely, but do it now.”

JP Morgan Market Insights: Housing: A Time To Buy

“[T]he numbers tell us it is a time to buy.”

Best Articles: The Housing Bust is Over

“You may be surprised to hear it, but thanks to lower mortgage rates and lower home prices, homes are affordable… They’re just as affordable now as they were right before they boomed in the 2000s.”

I’ll be out inspecting property and making offers on January 2nd. Hope to run into you! 🙂