2014 Residential Rental Market Survey

National Apartment AssociationUnits Magazine, September 2014

“2014 will likely go down as the formal beginning of the shift to a renter-based society.”

Thus sayeth the National Apartment Association in the September 2014 issue of Units Magazine.

Great for investors.

Not great for our kids and grandkids.

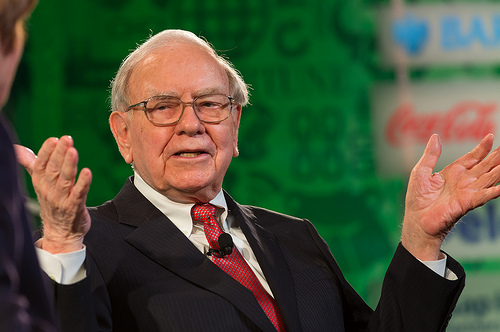

Buffett’s annual letter: What you can learn from my real estate investments

When Warren Buffett pontificates on two of his real estate investments, I think we should pause and pay attention. In this case, the real estate tutorial comes in the annual letter to Buffett’s shareholders!

When Warren Buffett pontificates on two of his real estate investments, I think we should pause and pay attention. In this case, the real estate tutorial comes in the annual letter to Buffett’s shareholders!

My son/partner Josh sent this to me and I think we both had slightly different takeaways. What impressed me is Buffett’s focus on his estimate of the future earnings of the assets when he considered their purchase, not the future value. (Josh is a numbers guy, and he’s going to write about his impressions of Buffett’s article in his monthly newsletter, so I’ll be interested in how his takeaways differ from mine.)

Future earnings. Not future value.

That’s easy on commercial properties, because the value of the property is determined by the income stream that it produces. So you can put all of your attention on increasing the income stream knowing that you are increasing value simultaneously. But homes are valued by comparables, they require a different discipline.

Having just lived through a recession as a landlord and real estate investor, I can tell you that we survived it because of the earnings from our investments. Cash flow saved us and got us through and in a stronger position than before the recession. We didn’t dwell on values because as long as we had positive cash flow, we were in a good position.

Please get a nice cup of your favorite beverage and take a few minutes to ponder Buffett’s message and it’s lesson for real estate investors:

Buffett’s annual letter: What you can learn from my real estate investments

By Warren Buffett

“Investment is most intelligent when it is most businesslike.” –Benjamin Graham, The Intelligent Investor

It is fitting to have a Ben Graham quote open this essay because I owe so much of what I know about investing to him. I will talk more about Ben a bit later, and I will even sooner talk about common stocks. But let me first tell you about two small nonstock investments that I made long ago. Though neither changed my net worth by much, they are instructive.

This tale begins in Nebraska. From 1973 to 1981, the Midwest experienced an explosion in farm prices, caused by a widespread belief that runaway inflation was coming and fueled by the lending policies of small rural banks. Then the bubble burst, bringing price declines of 50% or more that devastated both leveraged farmers and their lenders. Five times as many Iowa and Nebraska banks failed in that bubble’s aftermath as in our recent Great Recession.

In 1986, I purchased a 400-acre farm, located 50 miles north of Omaha, from the FDIC. It cost me $280,000, considerably less than what a failed bank had lent against the farm a few years earlier. I knew nothing about operating a farm. But I have a son who loves farming, and I learned from him both how many bushels of corn and soybeans the farm would produce and what the operating expenses would be. From these estimates, I calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity would improve over time and that crop prices would move higher as well. Both expectations proved out.

I needed no unusual knowledge or intelligence to conclude that the investment had no downside and potentially had substantial upside. There would, of course, be the occasional bad crop, and prices would sometimes disappoint. But so what? There would be some unusually good years as well, and I would never be under any pressure to sell the property. Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid. I still know nothing about farming and recently made just my second visit to the farm. More…

Warren Buffett on Gold vs. Income-Producing Investments

This is the best tutorial I’ve ever found on gold as an investment. So I thought I’d share:

This is the best tutorial I’ve ever found on gold as an investment. So I thought I’d share:

“Gold is a huge favorite of investors who fear almost all other assets, especially paper money. But what motivates most gold purchasers is their belief that the ranks of the fearful will grow.

“The world’s gold stock is 170,000 metric tons. If all of the gold were melded together, it would form a 68-foot cube – and fit in a baseball infield. At $1,750 per ounce … [last year] its value would be $9.6 trillion. Call this cube pile A.

Now create pile B. For 9.6 trillion, we could buy all U.S. cropland (400 million acres producing $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor selecting pile A over pile B?”

[Photo credit: Fortune Live Media via photopin]

Fund Your Retirement with Rental Income

The Donald Loves Real Estate

Donald TrumpThe bottom line is I love real estate. I like it because I think you are going to have massive inflation at some point, and to me real estate is a much better hedge against inflation than gold, which you can't touch.

Warren Buffet on CNBC:

Warren BuffetI'd Buy Up 'A Couple Hundred Thousand' Single-Family Homes If I Could.

The Greatest Opportunity Ever Is Just About to Pass You By

Dr. Steve SjuggerudHow much louder can I say this? This moment is the greatest opportunity ever to be an American homebuyer. It is the best moment in history. We may never see opportunity this great in our lifetimes. Time's "a-wasting" actually... You're about to miss the best moment, if you don't get on it, right now. The "V" bottom (as I call it) – where you can get the very best prices – is passing you by as I type.

Don’t miss today’s article by Dr. Steve Sjuggerud! Go there and read it now. Seriously! Do it now.

Don’t miss today’s article by Dr. Steve Sjuggerud! Go there and read it now. Seriously! Do it now.

Steve Jobs: Principles of Business

Steve Jobs

- Do what you love.

- Put a dent in the universe.

- Kick start your brain.

- Sell dreams not products.

- Say no to 1,000 things.

- Create insanely great experiences.

- Master the message.